Mens økonomer, investorer og ledere får et dårligt rap for at være tørre, er nogle lige så dygtige til ord, som de er med tal.

Fra nutidens ikoner som Warren Buffett og Jeff Bezos til fortidens store hoveder ved hver af disse finansielle koryfæer, hvordan man laver en sætning.

Og selvom disse skæve spøg er underholdende at læse, rummer hver enkelt en vigtig lektie for erfarne investorer og folk, der lige er startet.

Her er vores valg til de 10 bedste investeringstilbud nogensinde.

"Jeg er altid fuldt investeret. Det er en fantastisk følelse at blive fanget med bukserne oppe.”

Den amerikanske investor Peter Lynch forvandlede Fidelitys Magellan Fund til den bedst præsterende investeringsforening i verden i den tid, han administrerede den fra 1977 til 1990.

Så det er sikkert at sige, at Lynch vidste, hvad han talte om, da han skrev bogen One Up On Wall Street i 1989.

I denne passage forklarer Lynch, hvordan sommeren 1982 var en ødelæggende tid på aktiemarkedet. Da han lige havde købt et nyt hjem, var han bekymret for, hvordan han ville være i stand til at klare sine høje afdrag på realkreditlån.

Men hans formuer vendte næsten fra den ene dag til den anden. Markedet skød op med en vild fart og tog investorerne ud af vagt, da de fumlede for at købe tilbage til de aktier, de havde efterladt til døde. Alle undtagen Lynch.

Lynch var stadig fuldt investeret - som han altid er. Det er fordi han holder øjnene i horisonten. Han bliver ikke distraheret af hverdagens op- og nedture – eller endda de exceptionelle op- og nedture.

“Jeg vil hellere se nogen med en gambling-tendens tage til Las Vegas og tabe 200 $ end at satse på svinemaver, sølvmarkedet eller markedet for nye udstedelser. Du bør ikke spekulere undtagen med penge, du har råd til at tabe.”

Samuelson var den første amerikaner, der vandt Nobelprisen i økonomi i 1970. Det var i et interview med New York Times i 1971, at han tilbød denne smule visdom.

Akademikeren beklagede, at uinformerede investorer ofte falder i fælden med at søge råd fra selvmotiverede pengeforvaltere og så på, hvordan de involverede gebyrer "skærer væk" deres oprindelige investeringer over tid.

Men han tilføjede, "medmindre du kommer til at vide noget om, hvad du laver," gambler du effektivt. I så fald er det bedst at stole på professionel rådgivning for at hjælpe dig med at finde investeringer, der matcher din risiko og giver pæne nok afkast til at være på forkant med inflationen.

Heldigvis er det nemmere og mere overkommeligt at få professionel vejledning, end det var under Samuelsons dag.

“Det er ventetiden, der hjælper dig som investor, og mange mennesker kan simpelthen ikke holde ud at vente. Hvis du ikke fik genet for udskudt tilfredsstillelse, er du nødt til at arbejde meget hårdt for at overvinde det."

Munger er Warren Buffetts højre hånd i Berkshire Hathaway. Efter 60 års tæt samarbejde deler de et tæt venskab, en lignende investeringsstrategi og en forkærlighed for skæve observationer.

En væsentlig faktor, der har gjort dem begge til milliardærer, er deres tilsyneladende ubegrænsede lagre af tålmodighed. Mungers citat kommer fra et interview, han lavede med The Wall Street Journal i 2014.

Ligesom Buffett har Mungers mål altid været at tjene en masse penge - men han er aldrig bekymret for, hvor lang tid det vil tage. Ligesom mange smarte investorer stoler han mere på langsigtet vækst end forbigående modefænomener og går ikke i panik, når hans investeringer ikke tager fart med det samme.

Selvom det kan være svært at se andre hive ind kontanter, når deres satsning betaler sig, er det svært at fortælle en mand, der har en nettoværdi på 2 milliarder dollars, at hans strategi ikke virker.

"Kig ikke efter nålen, køb høstakken."

John C. Bogle, grundlægger af Vanguard Group, skrev bogen om investering - eller i det mindste en af de mere populære. Hans godbidder ovenfor kommer fra hans værk fra 2007, The Little Book of Common Sense Investing .

Selvom det kan lyde som om, han fortæller dig, at du vilkårligt skal investere i alt, så taler han virkelig om indeksfondenes styrke - noget Bogle ofte krediteres for at have opfundet.

I stedet for at bruge din tid på at gå på jagt efter en uopdaget diamant, vil en enkelt indeksfond give dig mulighed for at købe ind i en bred vifte af virksomheder.

Denne tilgang er ikke kun mindre risikabel, den plejer også at være mere rentabel. Indeksfonde har minimale gebyrer og klarer sig ofte bedre end smarte porteføljer forvaltet af professionelle aktievælgere.

Du kan komme ind i indeksfonde på mange forskellige måder - gennem din 401(k) på arbejdspladsen, et investeringsselskab, en rabatmægler - men den hurtige og nemme vej er at bruge en af nutidens populære investeringsapps.

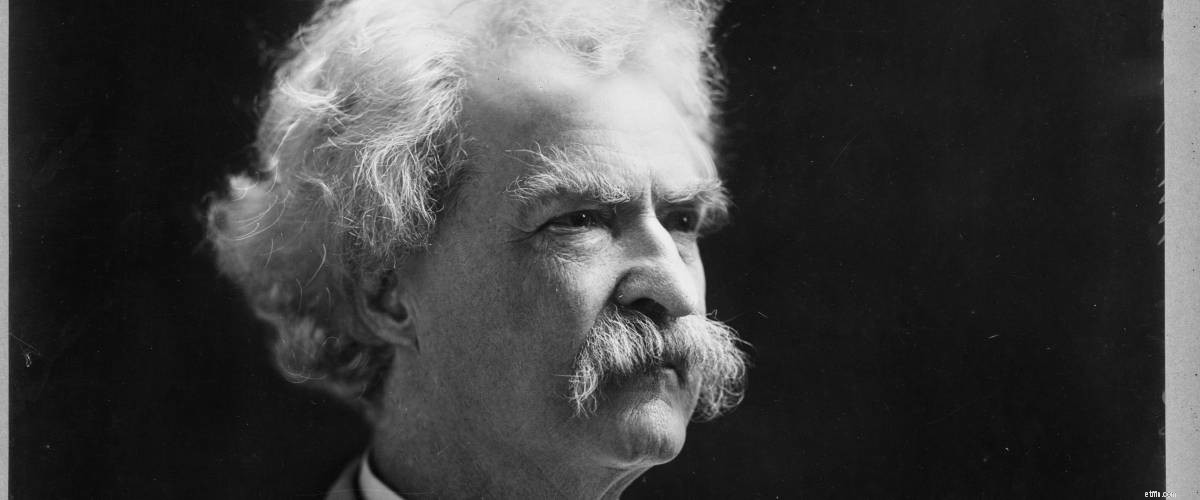

"Oktober:Dette er en af de ejendommeligt farlige måneder at spekulere i aktier. De andre er juli, januar, september, april, november, maj, marts, juni, december, august og februar.”

Husk, du kan lære lige så meget af fiaskoer, som du kan af succeser. Den legendariske amerikanske forfatter tjente en formue med sit forfatterskab, forelæsninger og ægteskab, men slog efterfølgende sig selv konkurs gennem dårlige investeringer og bliv rig-hurtig-ordninger.

Udgivet år senere i 1894, Twains The Tragedy of Puddn'head Wilson inkluderer denne sarkastiske observation i begyndelsen af et kapitel.

For noget, der startede som en engangslinje, har "Mark Twain-effekten" fået sit eget liv. Dette citat omtales ofte, når aktiemarkedet rapporterer langsommere afkast i oktober måned.

Når vi ser tilbage, startede Wall Street-krakket i 1929, Black Monday i 1987 og finanskrisen i 2008 hver i oktober eller i slutningen af september.

Takeaway er, at investorer altid skal være forberedt på, at alt går sidelæns i oktober - eller juli, januar, september, april, november, maj, marts, juni, december, august eller februar.

“The individual investor should act consistently as an investor and not as a speculator.”

Shortly before his death in 1976, the “father of value investing” gave an interview with the Financial Analyst Journal , sharing the insights of a 60-plus-year career.

Of the three rules he offered that individual investors should follow, the above quote was No. 1.

Graham explained that every decision an investor makes must be attributable to “impersonal, objective reasoning” that shows they’re getting more than their money’s worth for the purchase. Speculators, on the other hand, often trust their gut.

Even if you have impeccable instincts or great luck, Graham would argue that’s not a solid foundation on which to build a portfolio. Eventually it will fail, and your house may come crashing down around you.

If you’re looking to build on solid ground, there are lots of stable assets that still offer strong growth potential. You might consider investing in farmland, a profitable asset that has, until now, been difficult to buy into.

“Given a 10% chance of a 100 times payoff, you should take that bet every time. But you’re still going to be wrong nine times out of 10. We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs.”

Bezos, the billionaire founder of Amazon, has been jockeying for the title of richest man in the world for the past year. Even if he’s lost the top spot, with a net worth of $193 billion, he’s surely got some valuable insights on building your fortune.

The biggest lesson he can pass on — other than taking a great idea, having excellent timing and building it up in your garage — is to accept risk. One of the first steps he took in founding today’s e-commerce juggernaut was to quit his job.

Amazon, which originally focused on books, could have flopped. But as he wrote in his 2015 letter to shareholders, betting on something you see value in can pay off. And while striking out is always a possibility, every failure is also an opportunity to learn, experiment and refine your strategy.

If you decide to take a risk on an individual stock, make sure it's a measured one. Some apps offer "fractional trading," which allows you to invest in even the most expensive stocks with as little as $1.

“There are two kinds of investors, be they large or small:those who don’t know where the market is headed, and those who don’t know what they don’t know. Then again, there is actually a third type of investor — the investment professional, who indeed knows that he or she doesn’t know, but whose livelihood depends on appearing to know.”

As a neurologist and cofounder of Efficient Frontier Advisors, an investment management firm, Bernstein’s mixed background no doubt offers him a unique insight.

But he’s far from the only expert to warn investors to stay away from anyone overly confident about the future of the market.

What you can take from this quote — published in his 2001 book, The Intelligent Asset Allocator — is that it’s important to acknowledge what you don’t know.

Investing is like riding a bull:The second you get comfortable with a certain rhythm, you’ll get tossed off. But if you know you could be headed for a fall any minute, you’ll be on your guard and better able to react.

“The investor who says, ‘This time is different,’ when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.”

This quote, published in Templeton’s 1993 article 16 Rules For Investment Success, emphasizes the importance of learning from your mistakes.

That’s not to say Templeton — who became a billionaire investing in emerging markets worldwide — thought it possible to avoid mistakes entirely. In his mind, the only way to escape missteps is not to invest at all, which would be an even larger mistake.

Instead, he recommended keeping a cool head when you do make a wrong move. Instead of taking larger risks to dig yourself out of the hole, evaluate the situation, figure out what you did wrong and make sure you avoid that same trap in the future.

As the saying goes, the definition of insanity is doing the same thing over and over and expecting a different result. When you’re investing, remember what history has taught you and be open to trying different approaches.

“Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic.”

Warren Buffett is perhaps the king of cheeky and insightful investing quotes. This particular nugget is pulled from his book, The Essays of Warren Buffett:Lessons for Corporate America .

While he’s known for making smart picks as the “Oracle of Omaha,” Buffett is proudly outspoken about his long-term value-based strategy for investing, which has helped him amass his $100 billion fortune.

Buffett often jokes that his favorite holding period is “forever.” For example, he first bought shares of Coca-Cola back in 1988 and has never sold a single one.

To invest like Buffett, take a slow-and-steady approach, building and holding a diversified portfolio of companies with strong business models. One way to do that is to use an app that automatically invests your "spare change".