Har du nogensinde fået dette spørgsmål, når du fortæller nogen, at du er en investor på aktiemarkedet?

Jeg ved, at jeg er blevet stillet dette spørgsmål utallige gange, dog med visse ord, der er blevet omskrevet.

Hovedbudskabet er dog klart.

Kan den gennemsnitlige detailinvestor slå de professionelle i deres eget spil?

I One Up on Wall Street , afslørede den legendariske investor, Peter Lynch, hvordan hans 'amatør ’ tilgang til forvaltningen af Fidelitys Magellan Fund på mange milliarder dollar førte til, at han blev en af USAs førende pengeforvaltere og en af de mest succesrige investorer nogensinde.

Fra maj 1977 til maj 1990 var Lynch kaptajn for Magellan til et årligt afkast på 29,06% sammenlignet med kun 15,52% for S&P 500. For at kontekstualisere tingene, lad os se det afkast, man ville have, hvis du investerede $1 i Magellan og $1 i S&P 500.

Hans mantra er enkelt:

Gennemsnitlige investorer kan blive eksperter inden for deres eget felt og kan vælge vindende aktier lige så effektivt som Wall Street-professionelle ved at lave lidt research.

I denne kolossale artikel håber jeg at nedbryde de vigtigste takeaways, jeg har fået fra Peter Lynchs bog, nemlig - Peter Lynchs generelle retningslinjer for aktieinvestering.

Lektionerne undervist af Peter Lynch kan opdeles i 5 enkle takeaways:

Den allerførste regel, som bogen prædiker, er, at man skal holde op med at lytte til fagfolk !

Det betyder at ignorere de varme tips, anbefalingerne fra mæglerfirmaer og det seneste "kan ikke gå glip af"-forslag fra dit yndlingsnyhedsbrev - til fordel for din egen research.

Faktisk har amatørinvestoren adskillige indbyggede fordele, som, hvis de udnyttes, bør resultere i, at de klarer sig bedre end eksperterne, og også markedet generelt.

Dette skyldes følgende faktorer:

De professionelle har meget dybe lommer på grund af deres adgang til store summer af kapital. Dette stiller dem dog i en ulempe, da de ikke er i stand til at investere i små til mellemstore aktier. Det ville simpelthen ikke have en meningsfuld indvirkning på fondenes samlede præstation.

Dette var grunden til, at Warren Buffett gik over fra at investere i små cigaraktier til at købe hele virksomheder senere.

De muligheder, der er til rådighed for de gennemsnitlige detailinvestorer, er meget mere end for store investorer. Det er som at plukke fra et hav af fisk sammenlignet med fiskeri i Pasir Ris dam.

Vi skal bare udnytte det.

Mellem chancen for at opnå en usædvanlig stor fortjeneste på en ukendt virksomhed og forsikringen om kun at tabe et lille beløb på en etableret virksomhed, ville de professionelle hoppe på det sidste.

Succes er én ting, men det er vigtigere ikke at se dårligt ud, når du fejler. Dette skyldes, at fondsforvaltere er ansatte, og deres job vil højst sandsynligt afhænge af deres præstationer.

Kunder vil hellere høre nyheden om, at de tabte småt i DBS eller Keppel i forhold til at vinde stort i Goodland Group Ltd.

I mellemtiden, for den gennemsnitlige person, er der ingen, der ringer til os tidligt om morgenen eller sent ud på natten for at øve os på, hvorfor vi købte en knap så kendt tæller.

Vi træffer vores egne beslutninger uden at skulle forberede et 20 minutter langt forklaringsmanuskript for at imødegå potentielle modreaktioner.

Peter Lynch opfordrer os således til at udnytte sådanne fordele for at præstere på markedet, da vi er i stand til at bruge vores tid mere produktivt.

Det værste af alt er, at i det uheldige tilfælde af aktietankene, ville ingen være der for at kritisere din forudgående dom, som kan påvirke ens investeringsbeslutninger og handlinger.

På grund af det faktum, at fondsforvaltere forvalter andres penge, er det kunderne, der bestemmer, hvor meget kapital disse fondsforvaltere har til deres rådighed.

Disse mennesker er normalt ikke kyndige investorer og har en tendens til at trække deres penge tilbage under et bjørnemarked og lægge deres penge tilbage under tyre. Dette er præcis det modsatte af, hvad man bør gøre. Det efterlader fondsforvalteren med det dilemma at have for meget kapital, når alt er for dyrt, og for lidt, når alt sælges billigt.

I mellemtiden er vi vores egne fondsforvaltere, og vi har enebeføjelsen til at bestemme, hvornår vi skal indsætte og trække vores kapital ud. Dette giver os en nøglefordel, hvis vi meningsfuldt strategierer vores kapital.

Der ville ikke være nogen, der ville opfordre dig til at trække din kapital ud, når bestanden tanker andet end dit svage hjerte, som du skal lære at ignorere. (Lynch lægger stor vægt på det psykologiske aspekt, som vil blive dækket i næste afsnit)

Under det nuværende system er en aktie ikke rigtig attraktiv, før en række store institutioner har anerkendt dens egnethed, og et lige så stort antal analytikere (forskerne, der sporer de forskellige industrier og virksomheder) har sat den på købs- eller tilføjelseslisten.

Det betyder, at på det tidspunkt, hvor aktiens analyserapport udgives, skal man være sikker på, at de smarte penge allerede har købt aktien til meget billigere og attraktive priser sammenlignet med den pris, de i øjeblikket rapporterer.

Derfor er det bedre ikke at stole på sådanne "køb"- eller "tilføj"-rapporter udgivet for at identificere deres aktier og hellere bør screene for deres egne aktier med ens eget kriterium.

Dette skyldes også, at sådanne analyserapporter har kortere sigt i forhold til din egen investeringshorisont. Analytikere baserer deres vurderinger af aktier på kursmål, de sætter, og disse mål gives normalt inden for en 12-måneders (1 år) tidsramme.

For investorer (ikke swing-traders) er det forbundet med risiko at eje en aktie i et enkelt år.

Adfærdsøkonomerne De Bondt og Thaler kom til den erkendelse, at folk ikke træffer beslutninger rationelt. Deres beslutninger blev forvrænget af den store mængde kognitive fejl, de har at kæmpe med.

En etårig besiddelsesperiode udsætter således investoren for markedsudsving, da det tager tid for markedet til sidst at fungere som den velkendte vejemaskine.

Læs mere om holdeperioder i vores faktorbaserede investeringsguide.

Vi har alle chancen for at sige, “Det her er fantastisk; Jeg undrer mig over aktien” længe før de professionelle analytikere fik sit oprindelige fingerpeg.

Vi har alle visse industrier, produkter og tjenester, som vi ved mere om, end den gennemsnitlige person gør. Måske ved du mere om spilindustrien, fordi du er en magikerninja på niveau 99 og dominerer hvert spil, du rører ved. Måske arbejder du i modebranchen og er synkroniseret med de nyeste trends.

Lynch siger, at den gennemsnitlige person støder på en sandsynlig udsigt to eller tre gange om året - nogle gange mere.

Den nederste linje er, at vi alle har værdifuld og relevant information om børsnoterede virksomheder gennem vores hverdag. Dette er information, som fagfolkene enten ikke kender til endnu eller har brugt 100 timers research på at opnå.

Menneskelige følelser gør os til frygtelige aktiemarkedsinvestorer, fastslår Peter Lynch.

Den uvidende investor går konstant ind og ud af tre følelsesmæssige tilstande:

Han/hun er bekymret efter at markedet er faldet eller økonomien har syntes at vakle, hvilket afholder ham/hende fra at købe gode virksomheder til overkommelige priser

Så, når det næste tyreløb ankommer, kommer han/hun ind igen til højere priser og bliver tilfreds fordi deres besiddelser stiger. Dette er netop den tid, han/hun burde være bekymret nok til at tjekke de fundamentale forhold i forhold til den aktuelle pris, for at afgøre, om den er overvurderet og oppustet (men det gør han/hun ikke).

Endelig, når hans/hendes aktier falder i hårde tider, og priserne falder under, hvad han/hun betalte, kapitulerer de og sælger i en snit.

Mange mennesker betegner sig selv som "langsigtede investorer ” men kun indtil det næste store fald (eller lille gevinst), på hvilket tidspunkt de hurtigt bliver kortsigtede investorer og sælger ud for store tab eller lejlighedsvis minimal profit.

Tricket er ikke at lære at stole på dine mavefornemmelser, men snarere at disciplinere dig selv til at ignorere dem. Stå ved dine aktier, så længe virksomhedens grundlæggende historie ikke har ændret sig.

Lynch lover, at hvis du ignorerer markedets op- og nedture, og den endeløse spekulation i renter, på lang sigt, vil din portefølje belønne dig, hvis du grundlæggende foretager de korrekte valg.

Selv en af Warren Buffets største langsigtede investeringer nogensinde (Washington Post) lignede en fuldstændig taber i de første par år.

Washington Posts aktie faldt med omkring 20 % efter Buffetts køb og havde været der i tre år! Det var et papirtab på omkring 2,2 millioner dollars. Warren gennemgik dog regnskabet igen og fandt ud af, at der ikke var nogen væsentlig ændring i forretningsgrundlaget. Han besluttede derfor at holde og vente på, at markedet indså Postens sande værdi. Ved udgangen af 2007 var hans andel i Post vokset til 1,4 milliarder USD, hvilket er en gevinst på mere end 10.000 %.

Aktier med store langsigtede afkast kan være virkelig pinefulde investeringer på kort sigt.

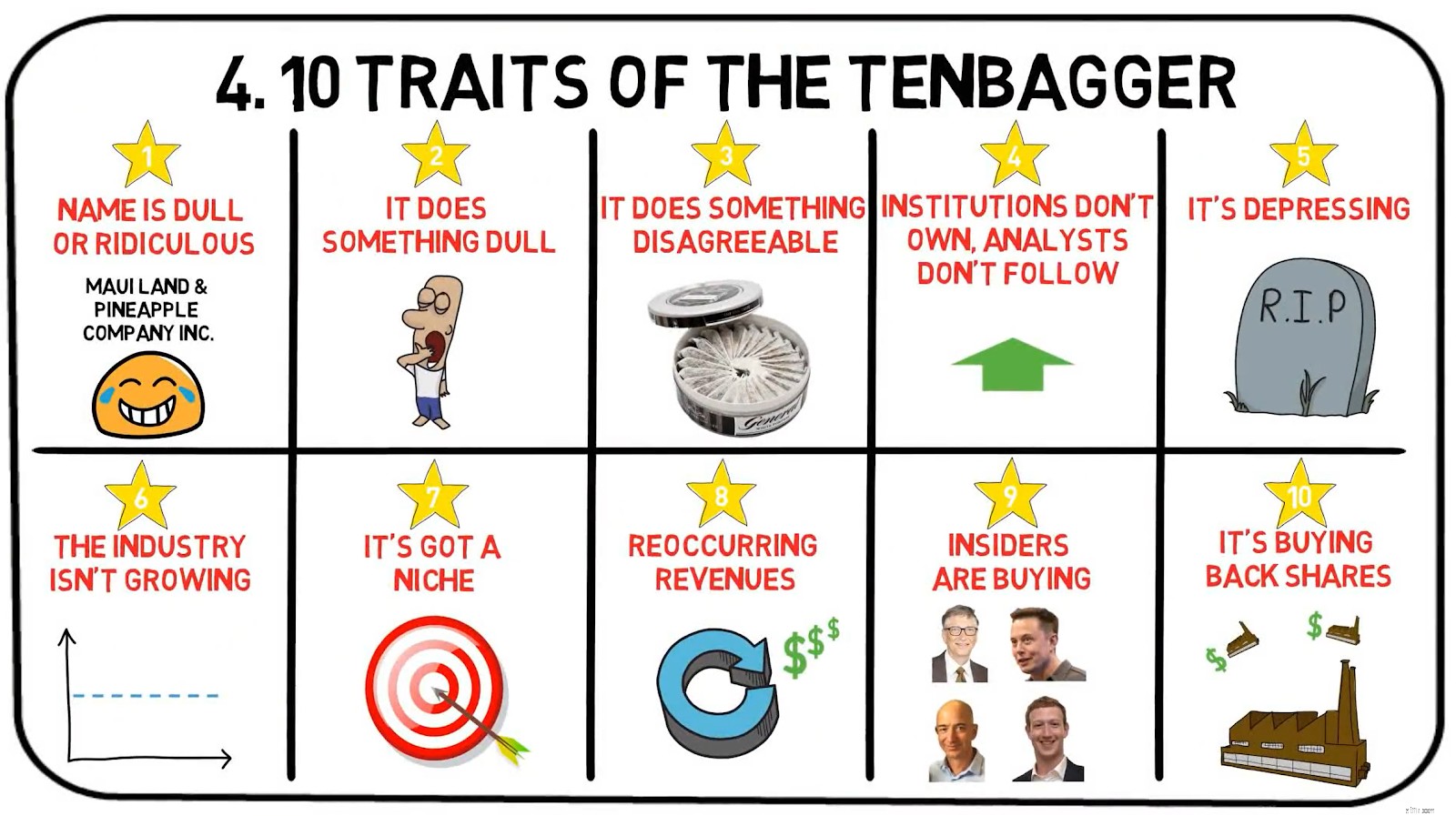

Den legendariske 'Tenbagger' er det udtryk, Lynch bruger til at beskrive en aktie, der har tifold din købspris. I One Up on Wall Street opregner han flere træk, som sådanne Tenbaggers bør omfatte.

I sin bog kommer Peter Lynch med Greatest Company Of All – En ideel Lynch Tenbagger.

Dette mytiske firma hedder Cajun Cleansers.

Det var den magiske virksomhed, Peter Lynch, der blev beskrevet i kapitlet om egenskaber ved en drømmevirksomhed.

Cajun Cleansers er engageret i den kedelige forretning med at fjerne meldugpletter fra møbler, sjældne bøger og draperier, der er ofre for subtropisk fugt. Ikke en eneste analytiker fra New York eller Boston har nogensinde besøgt Cajun Cleansers, og ingen institution har heller købt deres aktier.

Nævn Cajun Cleansers ved et cocktailparty, og snart vil du tale med dig selv. Det lyder latterligt for alle inden for hørevidde.

Mens de har ekspanderet hurtigt gennem landet, har Cajun Cleansers haft et utroligt salg. Dette salg vil snart accelerere, fordi virksomheden netop har afsløret et patent på en ny gel, der fjerner alle mulige pletter fra tøj, møbler, tæpper og badeværelsesfliser. Patentet giver Cajun den niche, den har ledt efter.

Virksomheden planlægger at tilbyde livstidsfarveforsikring med årlige rater, som kan betale på forhånd for en garanteret fjernelse af alle de fremtidige pletulykker, de nogensinde forårsager på enhver overflade.

Aktien åbnede til $8 ved en børsnotering for syv år siden og steg snart til $10. Til den pris købte de vigtige virksomhedsdirektører så mange aktier, som de havde råd til.

Jeg besøger virksomheden og finder ud af, at ethvert trænet krebsdyr kunne overvåge fremstillingen af gelen.

Selvom Cajun Cleansers er en fiktiv forretning, kan du få en fornemmelse af, hvordan en tenbagger så ud i øjnene på den legendariske Magellan-fondsforvalter. Den førnævnte historiebeskrivelse er ikke for langt væk fra forretningsmodellerne og eksisterende miljøer i flere virksomheder i vores midte.

Hot aktier kan stige hurtigt, normalt ude af syne af kendte landemærker af værdi, men da der ikke er andet end håb og tynd luft til at støtte dem, falder de lige så hurtigt.

Lad os tage et kig på Best World, en varm aktie, der væltede, efter at Bonitas Research offentliggjorde en 28-siders rapport, der satte spørgsmålstegn ved ægtheden og lovligheden af premium-hudplejefirmaets overskud.

Bortset fra den mest sexede aktie i den hotteste industri, er her 4 andre træk ved de aktier, Peter Lynch helt sikkert ville undgå:

Pas på, når nogen betegner aktien som den næste "Facebook" eller den næste "Google", for det er den næsten aldrig.

Faktisk er disse blot markedsføringstaktikker og klikagn, som er taktisk placeret for at lokke dig til at læse videre.

"Denne aktie, firma ABCXYZ, kunne være som at købe Facebook for 2 USD pr. aktie"

Oftere end ikke sammenligner de sådanne aktier med de store spillere for at gøre dem relaterbare og for at tiltrække de uvidende investorer, der køber efter rygter.

Dette lokker dem igen, og det næste du ved, han forpligter halvdelen af sin opsparing til pensionering til at købe aktier i ABCXYZ, mens han selvtilfreds siger til sine venner, at han kom tidligt på båden.

Nogle kalder det diversificering, men Lynch kan lide at betegne dårlige beslutninger som Diværre ifying.

I stedet for at købe aktier tilbage eller hæve udbytte foretrækker profitable virksomheder ofte at sprænge deres penge på tåbelige opkøb.

Oftere end ikke må man spørge sig selv, om virksomhedens ekspansion er relateret til kernedriften.

Et par fiktive (overdrevne) eksempler ville omfatte:

Nu ville det lyde fjollet og lade dig undre dig selv over, hvordan ideen om sådanne opkøb formåede at passere gennem kontrol af ledelsen og ledelsen. Den hårde sandhed er, at sådanne elendige udvidelser findes.

Hvis vi trækker på folks smertefulde lektion af Hyflux, kan vi tydeligvis se et rystende tilfælde af forværring, da virksomheden ekspanderede fra innovative vandløsninger til at generere strøm og energi.

Som den første i Singapore og Asien forventedes Tuaspring Integrated Water and Power Project at øge effektivitetsniveauet og reducere omkostningerne ved afsaltning.

Kraftværket blev åbnet i 2016, og det var Hyflux' første satsning på energibranchen.

Læg mærke til, hvordan Hyflux vælger at rapportere deres overskud og indtjening ved at ekskludere Tuaspring?

Dette var fordi Tuaspring var en hæmsko for virksomhedens indtjening og overskud, Hyflux udtalte, at den "langvarige svaghed" på det lokale energimarked var en af hovedårsagerne til dets tab.

Læs mere om den skæbnesvangre lektion her.

Disse aktier betegnes som "Longshots".

De opfattes ofte som værende på randen af at gøre noget mirakuløst, såsom at helbrede enhver form for kræft, løse global opvarmning eller skabe verdensfred.

Whisper-aktier har en hypnotisk effekt, og som regel har historierne en følelsesmæssig appel. Det er her, syren er så fristende, at du glemmer at bemærke, at der ikke er nogen bøf.

Lyder meget som en MLM-ordning, hvor Moringa Elixir lover at løse enhver form for sygdom...

Fælles for alle disse longshots udover det faktum, at du tabte penge på dem, var, at det havde en fantastisk historie uden substans.

Virksomheden, der har 25 – 50 % af sit salg afhængig af en enkelt kunde, er i en prekær situation.

Hvis tabet af én kunde ville være katastrofalt for en leverandør og have en enorm belastning på sin toplinje, ville Lynch være forsigtig med at investere i leverandøren.

I 2018, AEM Holdings var stærkt afhængig af sin ene større kunde, selvom den ikke specifikt identificeres af virksomheden, menes at være Intel, en af de største chipproducenter i USA, som bidrog med omkring 93 % af den samlede omsætning

Dette er også en svag forhandlingsposition at være i, og virksomheden kan potentielt blive presset af denne eneste kunde og blive udsat for dens indflydelse.

I de sidste kapitler af bogen afslører Lynch en opsummerende tjekliste over nogle (ikke alle) vigtige ting, han gerne vil lære om aktier, før han går dybere.

Bliv ikke forvirret af Peter Lynchs hjemmefundne enkelthed, når det kommer til at lave flittig research – grundig research var en hjørnesten i hans succes.

Når han følger op på den første gnist af en god idé, fremhæver Lynch flere grundlæggende værdier, som han forventede at blive opfyldt for enhver aktie, der er værd at købe.

Som man ville bemærke, identificerer Peter Lynch en aktie ved hjælp af kvalitativ analyse, før han dykker ned i den kvantitative.

Hos Dr. Wealth mener vi dog, at man bør udføre kvantitativ analyse på en aktie, før man dvæler i det kvalitative.

På den måde kan vi ignorere enhver følelsesmæssig skævhed, som kan gøre dig skade.

Vi vil gerne fremhæve, at begge tilgange ville gøre arbejdet, bare husk ikke at glemme nogen af dem i din forskning.

Al aktieanalyse er båret af en kvantitativ og en kvalitativ komponent.

Vi håber, at du har lært noget nyttigt indtil videre. I de næste par sessioner vil jeg dykke ned i 3 aktiekategorier, som Peter Lynch brugte. De er:

Bemærk, at Peter Lynch faktisk har 6 aktiekategorier; Langsomme avlere, Stalwarts, Hurtigvoksende, Cyclical, Asset plays, turnarounds.

Også, hvis du er lige så imponeret og rørt af USA's nummer et pengeforvalter, som jeg er, kan du overveje at købe hans bog. Kindle-versioner kan være billigere, hvis det er mere din stil at læse bøger elektronisk.

Vi afholder i øvrigt regelmæssige introduktionskurser for at dele vores strukturerede investeringsstrategi. Hvis du gerne vil vide, hvordan vi har kombineret flere af vores egne strategier for at finde vores egne vækstaktier, kan du lære mere her.

Stalwarts er tidligere hurtigtvoksende virksomheder, som er modnet til større virksomheder med langsommere, mere pålidelig vækst (3 % om året er det forventede gennemsnit ).

Derudover producerer trofaste virksomheder varer, der er nødvendige og altid efterspurgte (tænk mad, vand, elektricitet, olie ) , hvilket sikrer et stærkt, stabilt cash flow.

Selvom de ikke forventes at være toppræsterende på markedet, hvis de købes til en god pris, trofaste tilbyder betydelige overskud på omkring 50 % eller deromkring over en 4-5 års besiddelsesperiode.

På grund af deres stærke pengestrøm genereret fra de nødvendige produkter, er trofaste generelt i stand til at betale et udbytte.

Eksempler på Stalwarts inkluderer Macdonald's, SBS Transit og Procter&Gamble.

Derudover krævede Peter Lynch, at Stalwarts havde et P/E-vækstforhold (PEG) på mindre end 1,0. PEG-forholdet beregnes ved at dividere en virksomheds Price-to-Earnings (PE) forholdet ved sin indtjeningsvækst .

Lynch anså virksomheder med PEG under 1,0 for at være underpris, og virksomheder med en PEG på under 0,5 for at være en rigtig god handel. Dette er let at forstå, da hvis du køber en virksomhed med en PEG på mindre end 1, betaler du mindre end én dollar for en dollar i indtjeningsvækst. Og at betale mindre for mere er det grundlæggende princip for al investering.

For udbyttebetalende virksomheder har Lynch yderligere indregnet udbytteafkastet for at nå frem til et afkastjusteret PEG-forhold. Walmart er ofte blevet nævnt som et godt eksempel på Lynchs Stalwart aktiemetodologi.

På et tidspunkt handlede Wal-Mart for tæt på 20x PE. Hvilket betød, at den gennemsnitlige investor ville betale $20 pr. dollar i indtjening.

Lynch fastslog, at virksomheden stadig voksede med 20-30% med meget mere plads til vækst.

Dette betyder, at den reelle pris for indtjening, en investor ville betale, ville være 20-30 % mindre hvert år i de næste par år. $20 var en handel. Og Wal-mart skuffede ikke og fortsatte med at vokse med 20-30% i de næste 20 år.

Vi kender nu nogle af egenskaberne ved Stalwarts.

Vi har tilføjet nogle yderligere kriterier for at være ekstra stringente med vores aktieudvalg og indsnævre vores fokus til kun de bedste aktier, der skal undersøges. Dette er de sidste kriterier, som vi vil bruge til at finde Stalwarts i Singapore.

Ovenstående kriterier burde være ret selvforklarende.

I lyset af ovenstående kriterier har vi valgt 3 Stalwarts, som vi vil dække i dag, og som vi føler har et betydeligt vækstpotentiale. Derudover vil alle aktierne have et eller flere af følgende træk ved en tenbagger, hvilket repræsenterer et potentielt afkast på 10X af det, du har investeret.

| Markedsværdi. | 253 mio. USD |

| Historisk udbytte | 3 % |

| Ikke i Sunset Industry | Ja |

| PE-forhold | 21.73 |

| Industriens gennemsnitlige PE-forhold | 23.8 |

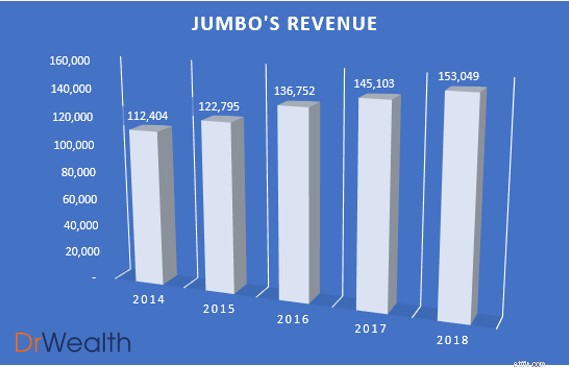

Som det ses i diagrammet er Jumbos omsætning vokset år for år med en vækst på 5 % fra $145 mio. i 2017 til $153 mio. i 2018.

Vi vil også potentielt forvente, at omsætningsvæksten vil fastholde eller endda stige, da Jumbo ser mod at få et fastere fodfæste i Kina og andre regioner.

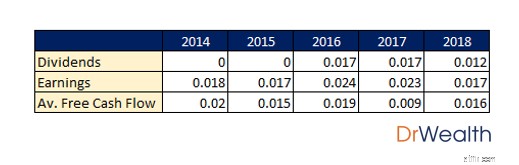

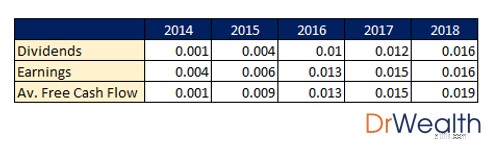

Jumbo har udloddet udbytte i de sidste 3 år siden dets børsintroduktion, og dets indtjening og frie pengestrøm har været mere end udbyttet med undtagelse af 2017.

Dette skyldtes dets hidtil usete udvidelser til Beijing, Shanghai, Taiwan og Ho Chi Minh City. Dette retfærdiggør faldet i Free Cash Flow i 2017 og det efterfølgende fald i udbytteudlodning i 2018.

Jumbo sigter mod at tackle sine vækstudsigter med en trestrenget tilgang:

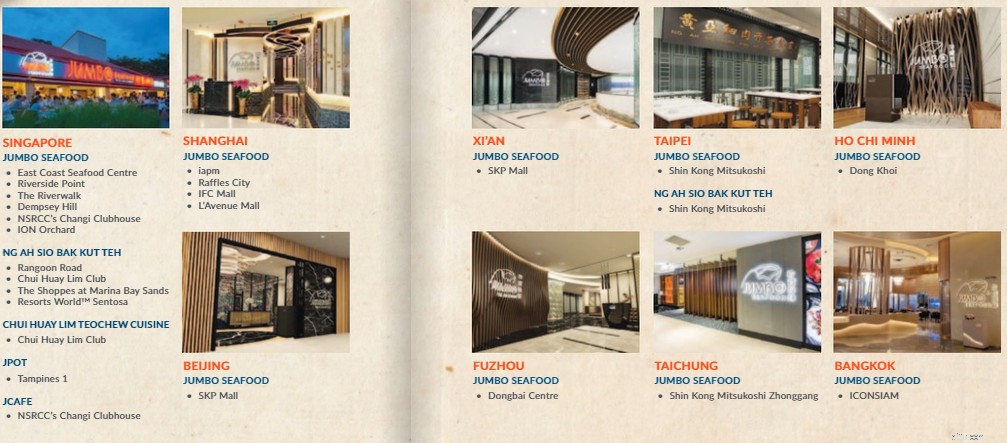

Ved at diversificere sin restaurantportefølje er den i stand til at kopiere nogle dele af sin succesrige forretningsmodel for fisk og skaldyr til andre mærker såsom Ng Ah Sio Bak Kut Teh. Dette kan således blive endnu en rentabel satsning for koncernen, hvis de er i stand til at eksekvere det godt. Jumbo har til hensigt at introducere Ng Ah Sio Bak Kut Teh til Kina og vil åbne mindst en mere Ng Ah Sio Bak Kut Teh-outlet i Taiwan og en mere Tsui Wah Hong Kong-stil "Cha Chaan Teng"-outlet i Singapore i løbet af de næste 12 måneder .

Ydermere, ved at ekspandere til udenlandske forbrugermarkeder, er Jumbo eksponeret for en større adresserbar forbrugerbase.

Skulle de være i stand til at opbygge deres brand så succesfuldt, som de har gjort i Singapore, ville der være lyse udsigter forude for koncernen.

The Edge Singapore rapporterede netop i dag, at Jumbo åbnede sin første franchisebutik i Gangnam, Seoul. Dette bringer antallet af Jumbo-fisk og skaldyr på tværs af Asien til 18 med franchise-forretninger i Bangkok, Fuzhou, Ho Chi Minh, Taipei og Taichung.

Jumbos investering og ekspansion i Kina er begyndt at modnes, da det i øjeblikket tegner sig for ca. 20,4 % af dets omsætning. Sådanne tal er et stærkt bevis på dens succes i Kina.

Skulle ledelsen og ledelsen opbygge deres markedsposition i de forskellige regioner ved at udvide deres forretninger så succesfuldt, som det har gjort i Kina, kan vi potentielt se en hidtil uset vækst i virksomhedens salg.

I hjemmebasen, som stadig danner grundlaget for virksomhedens indtjeningsvækst, åbnede Jumbo et outlet hos ION Orchard.

Dette markerer en betydelig milepæl som deres første restaurant i Orchard, det førsteklasses shopping- og underholdningsbælte. Dette viser, at selvom Jumbo er midt i oversøiske udvidelser, gør det det stadig vigtigt at forblive relevant og ekspandere på det lokale marked for at bevare sin vigtigste salgskilde.

Den har en niche

Når du hører navnet Jumbo, er det billede, der først dukker op i dit sind, bestemt en chili-krabbe/peberkrabbe. Det er præcis Jumbo's Niche, der sælger en af Singapores ikoniske/berømte lokale retter og er kendt for det.

Bortset fra at finpudse deres Chilli Crab-ekspertise, gør det at have en niche Jumbo meget mund-til-mund-venlig, hvilket betyder flere muligheder for at få budskabet ud om din virksomhed.

At have en sådan konkurrencefordel i forhold til sine modparter er vigtigt for restauranter som Jumbo, der bor i en stærkt konkurrencepræget F&B-industri. Dette sikrer, at dets salg ikke vil blive uhyre påvirket i tilstedeværelsen af nye indgange til fisk og skaldyr på grund af høje kundefastholdelsesrater.

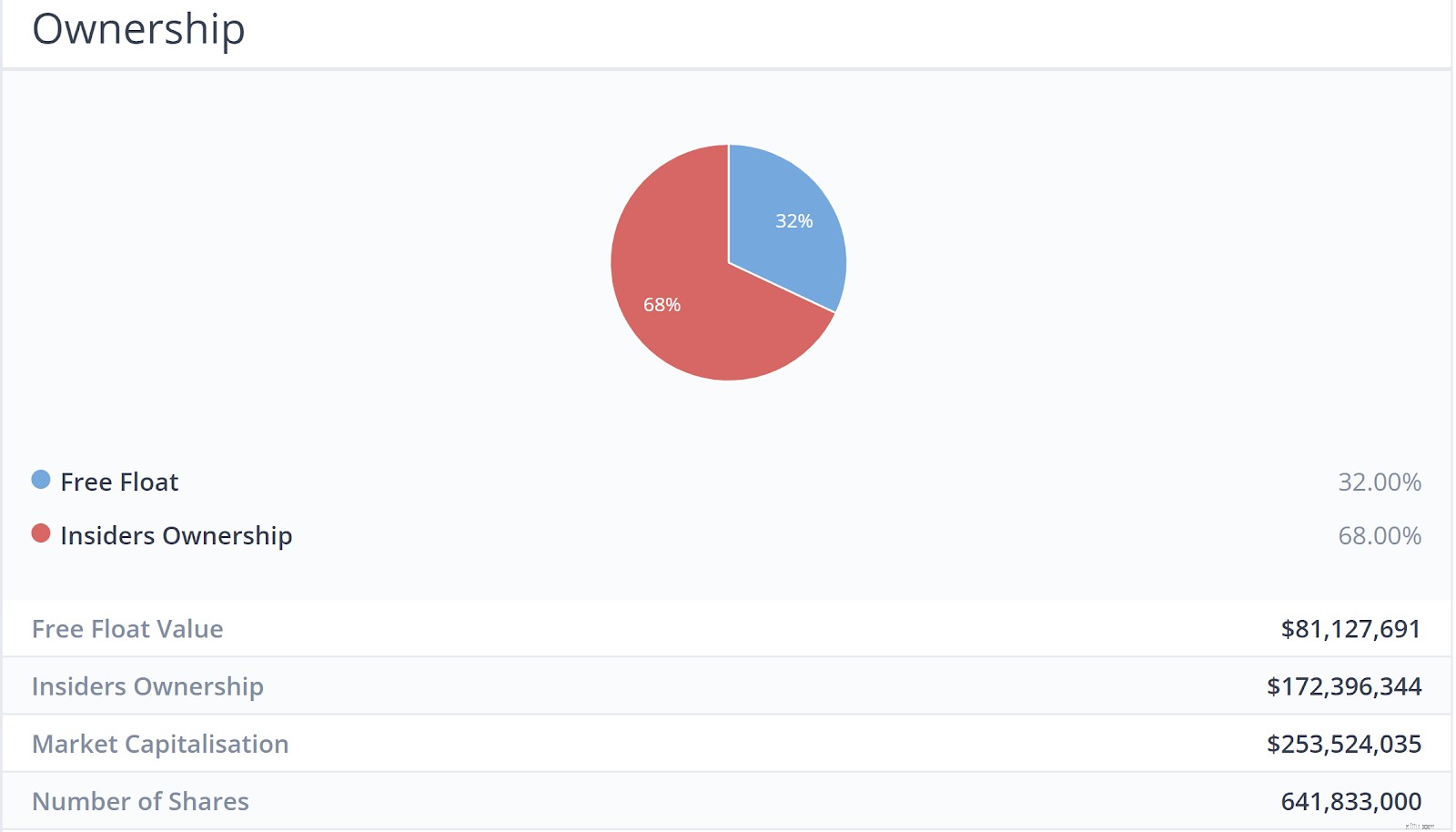

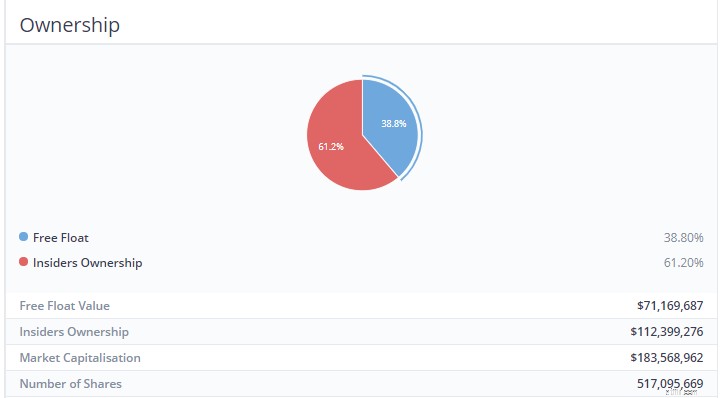

Skin in the Game (Insiders are buying/owning shares)

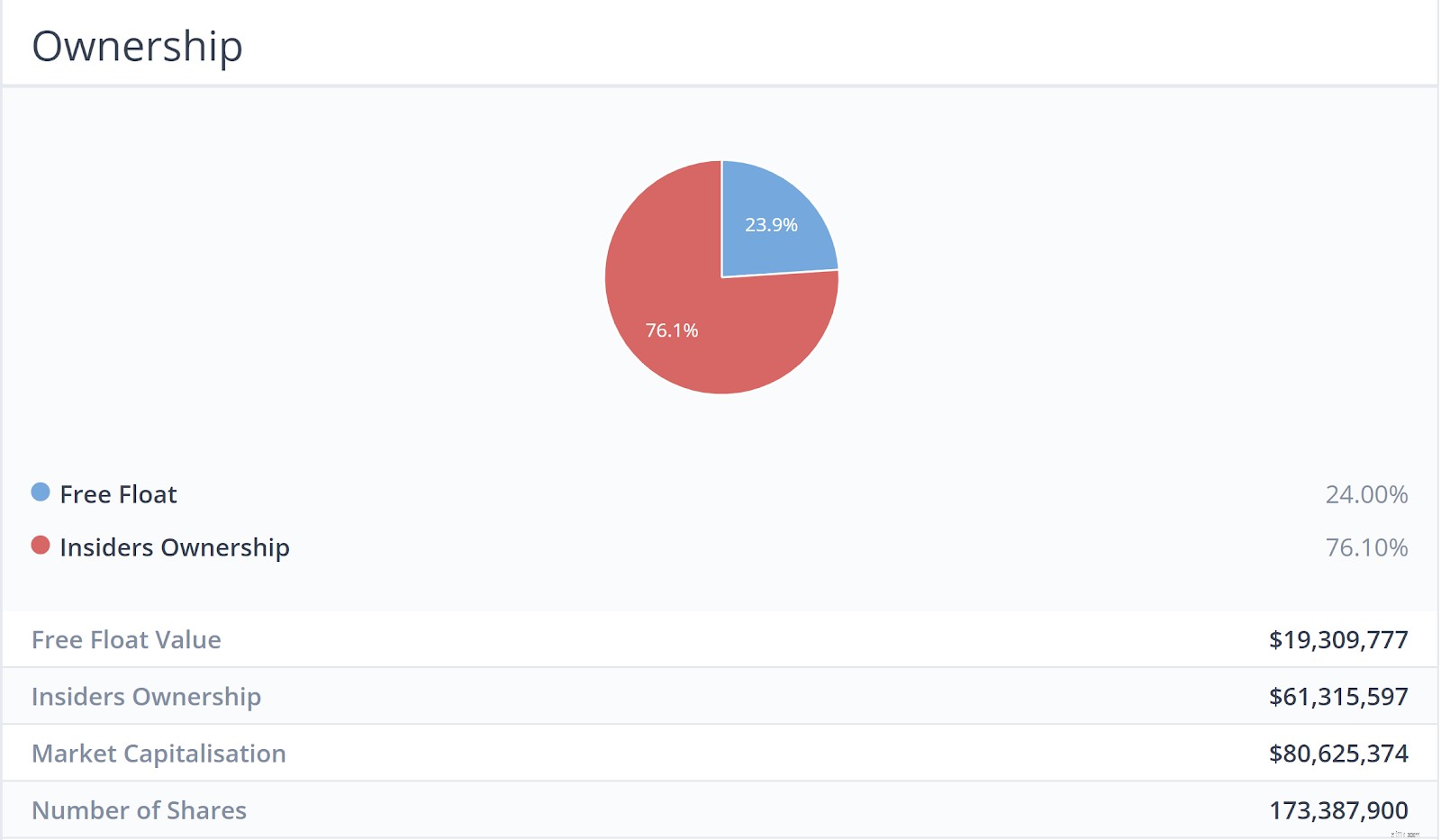

If the Chairman or the CEO of a company owns more than 50% of shares in the company, their interests are more likely to be more aligned with the shareholders.

That is because they are unlikely to take actions to harm their own wealth and would look towards improving the prospects of the company.

As can be seen, insiders of the company owned a majority of the shareholder-ship. Therefore, it proves that the management has skin in the game.

The Company is buying back Shares

Buying back shares is the simplest and best way a company can reward its investors, according to Peter Lynch.

If it has faith in its own future, then it would invest in itself, just as shareholders do.

Jumbo has been doing just that, posting notices from 31st May – 11th June on their daily share buy-backs.

| Market Cap. | $81M |

| Historical Dividend Yield | 4.27% |

| Not in Sunset Industry | Yes |

| PE Ratio | 24.22 |

| Industry Average PE ratio | 23.8 |

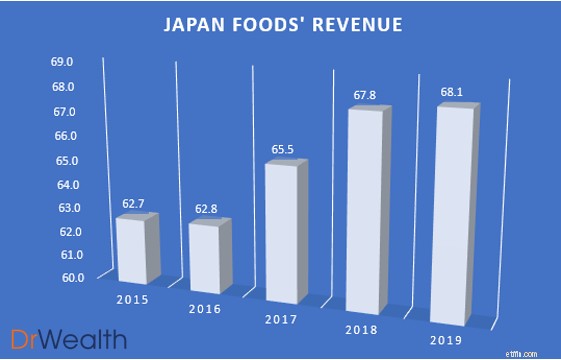

As seen in the chart, Japan Foods’ revenue has been growing year on year, albeit not substantially from 2018 to 2019. However, we would expect the top line to grow with the growth potential lined up for Japan Foods.

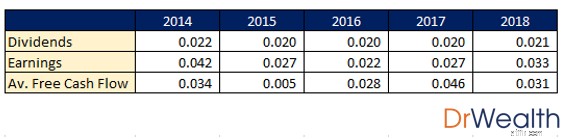

Japan Foods has been distributing consistent dividends for the past 5 years and its earnings and free cash flow has been more than the dividends distributed for all 5 years.

Similar to Jumbo, Japan Foods business growth model focuses on three things:

Japan Foods’ approach moving forward seems logical and sound. Their joint venture under the franchise “Dining Collective” is a great leap forward in their overseas ambitions, allowing them to unlock a larger customer pool by expanding their outlets and having a presence in foreign markets.

They also managed to secure and launch a new franchised ramen brand “Konjiki Hototogisu”, known for its clam-flavoured broth. The restaurant chain also has One Michelin Star.

They have since opened four restaurants under this brand in Singapore, with the latest one being launched in Jewel Changi.

This is definitely not a form of diworseification as Japan Foods aims to tackle the premium market in Singapore whilst maintaining more affordable brands for the general crowd. This caters to the tastes and wallets of the consumers, unlocking more potential for growth.

Lastly, they launched two brand extensions of “Ajisen Ramen”, named “Den by Ajisen Ramen” and “Kara-Men”.

By refreshing and rejuvenating brands, it allows Japan Foods to remain competitive and relevant in the market. To date, the response to the two variations has indeed been well with an increase in same-store sales following the rebranding.

It’s got a Niche

Lynch found that if a company focused on a particular niche, it often had little competition. Japan Foods is one of the leading F&B groups in Singapore specializing in Japanese cuisine. With 19 Dining Brands under their name and 50 locations islandwide, it seems that their restaurant network is stable and well-built.

Skin in the Game (Insiders are buying/owning shares)

As can be seen, insiders of the company owned a majority of the shareholder-ship. Therefore, it proves that the management has skin in the game.

The Company is buying back shares

Japan Foods has also been posting notices in Aug 2018, Sep 2018, Dec 2018 and Feb 2018 on its daily share buybacks. Such notices can either be found on the SGX website or their investor relations website.

| Market Cap. | $186M |

| Historical Dividend Yield | 6.12% |

| Not in Sunset Industry | Yes |

| PE Ratio | 21.53 |

| Industry Average PE ratio | 47.95 |

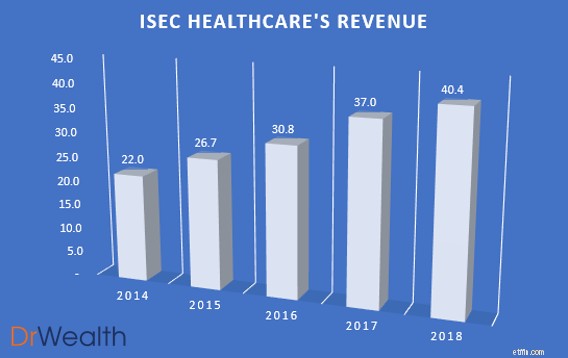

As seen in the chart, ISEC’s revenue has been growing year on year with a 9.19% growth from $37m in 2017 to $40.4M in 2018. We would also potentially expect the revenue growth to increase due to the region’s aging population and increasing awareness towards seeking early treatment for ophthalmology issues will continue to drive demand and sales upwards.

ISEC Healthcare has been distributing consistent increasing dividends for the past 5 years and its earnings and free cash flow has been more than or equal to the dividends distributed for all years.

We see growth potential in ISEC Healthcare’s business due to 3 key reasons:

Due to ageing populations, requirements for eye health care will increase. This is because there are higher incidences of Cataract, Glaucoma, Age Macular Degeneration, Dry Eyes and Vitreoretinal.

Furthermore, not only is government spending on healthcare services increasing across the region in line with changes in demographics, rising income levels and subsequent private insurance coverages has led to an increase in individual spending on private eye-care services.

ISEC Healthcare is also keen on regional expansions with large populations. They took a positive step towards this direction by announcing the incorporation of ISEC MYANMAR. They are also keen on leveraging upon the aforementioned trends to continue pursuing investment opportunities and explore up-and-coming markets such as China, Indonesia and Vietnam.

It’s got a Niche

In terms of devising a business strategy, a niche company can remain focused on its area of specialization. Over time, a niche company can develop a reputation for its work in a given field. This reputation allows a niche company to position itself as a leader and expert in the field. Niche companies focus on doing one thing well rather than doing many things only adequately. ISEC Healthcare definitely has an Eye Specialist Niche. This gives it better margins as a specialist clinic than a generalist.

Skin in the Game (Insiders are buying/owning shares)

As can be seen, insiders of the company owned a majority of the shareholder-ship. Therefore, it proves that the management has skin in the game.

Not many Institutions own it

Peter Lynch states that if you find a stock with little or no institutional ownership, you’ve found a potential winner. Such companies have not been discovered by the smart money, giving it an extra potential upside.

So there you have it. The Stalwart Category explained in accordance with Peter Lynch’s guidebook.

Lynch expected stalwarts to deliver gains of 30% to 50%, after which he would sell them and find new, undervalued counters. These are the stocks that he would frequently replace with others in this category.

Next, we’re going in-depth into one of the six different categories pointed out by Lynch – The Fast Growers

These counters are among Lynch’s favourite investment. These stocks typically have the characteristics of small, aggressive new enterprises that grow at 20-25% a year. Lynch claims that if you were to choose these Fast Growers correctly, it could potentially be a 10 to 40 bagger.

We would be picking stocks utilizing the following criteria to select our Top 3 Fast Growers:

To elaborate a little further on the above criteria:

At Dr Wealth, we believe that the Singapore Stock Exchange Market is more catered towards investors with the strategy of earning a passive income. Thus, while SGX is a fantastic market for dividend stocks/REITs there are much better growth stocks available beyond SGX.

We would, therefore, apply the aforementioned criteria in the US markets as we feel that growth stocks are aplenty there.

Given the above criteria, we shortlisted 3 Fast Growers that we will cover today, which we feel have significant growth potential. In addition, all of the stocks will have one or more of the following traits of a ten-bagger, representing a potential return 10X of what you invested.

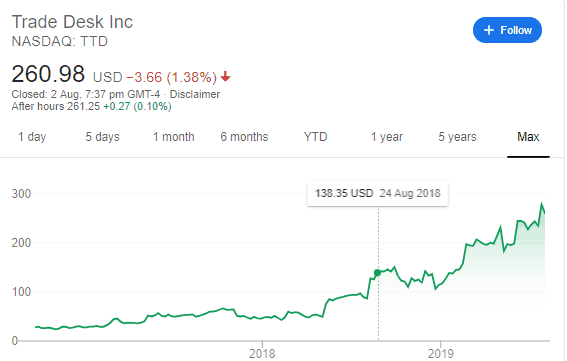

| Market Cap. | $11.62B |

| Debt-to-Equity Ratio | 18.54 |

| Stable Top &Bottom Line Y-O-Y | Yes |

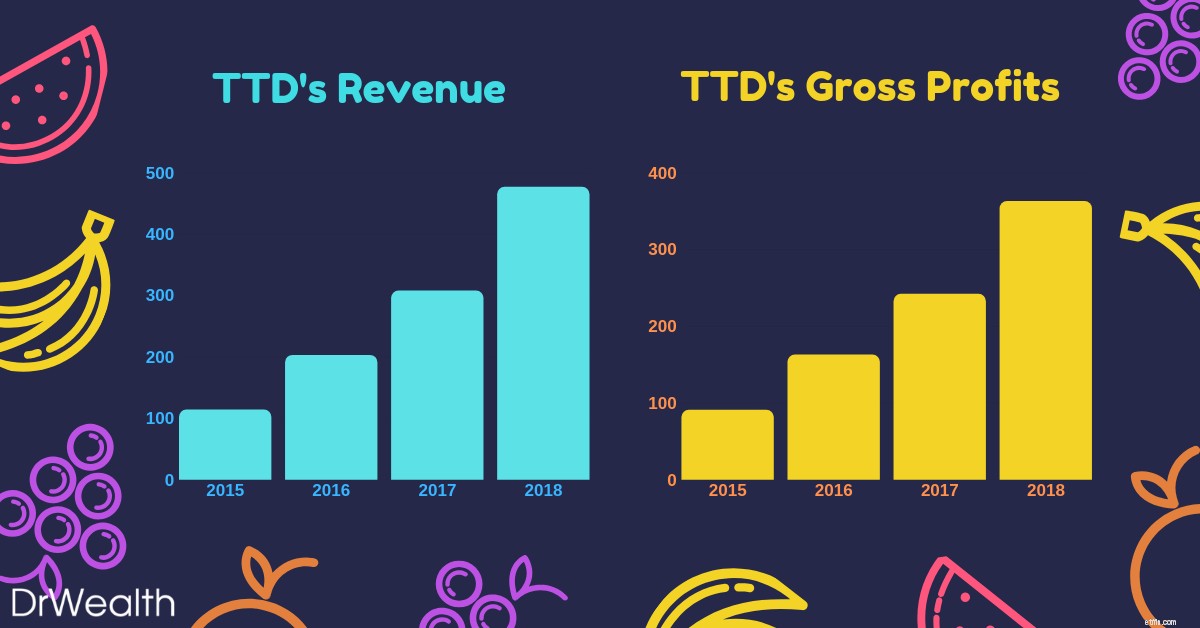

As seen in the graph, The Trade Desk’s earnings have been growing year-on-year from 2015 to 2018. Earnings grew from $242M in 2017 to $363M in 2018, displaying a whopping 50.1% growth versus the prior year.

We would also potentially expect the earnings growth to maintain or even increase as The Trade Desk looks towards gaining a firmer foothold in China and other regions.

What does The Trade Desk do?

Do you realize that what you have searched on Google would start popping up in your Facebook/Instagram/Youtube feeds as adverts?

Eerily, most of the adverts are also very relevant to what you are interested in. Welcome to the world of Programmatic Advertising!

The Trade Desk is essentially a programmatic advertising company which operates a cloud-based platform that lets companies streamline their efforts to the apt consumer’s groups they are targeting.

This, in turn, cuts down the advertising expenditure of the company and allows it to achieve a greater ROI with its adverts.

TTD allows its customers to buy targeted ad space on many different channels like social media, video/streaming, audio and many more.

The Trade Desk’s Growth Potential

Jeff Green, chief executive officer and founder of The Trade Desk, sees China as an untapped market.

This strategic move was solidified with its launch in China earlier this year, inking deals with tech powerhouses such as Alibaba, Baidu and Tencent.

Thus far, companies such as Sheraton Hotels have successfully utilized the platform to expand their customer base greatly through its targeted advertisements.

In the next five years, CEO Jeff Green claims that The Trade Desk plans to turn China into one of its top three markets.

The company says international revenue currently accounts for about 15% in revenue but expects it to grow to roughly two-thirds of its total revenue as the programmatic industry matures.

For investors, this means that there is still huge untapped potential for The Trade Desk to grow as it would take awhile for one to see material contributions from the China market to its top &bottom lines.

With the company already growing at such a blistering pace Y-O-Y without tapping on China, one would potentially expect their growth to sustain or even increase in the future.

With earnings growth, this would inevitably lead to greater appreciation in stock prices, thus allowing the investor to potentially attain a multi-bagger.

| Market Cap. | $37.38B |

| Debt-to-Equity Ratio | 5.3 |

| Stable Top &Bottom Line Y-O-Y | Yes |

As seen in the graph, Shopify’s earnings have been growing year-on-year from 2015 to 2018. Earnings grew from $380M in 2017 to $596M in 2018, displaying a huge 56.8% growth versus the prior year.

Shopify has secured its status as the e-commerce platform of choice for small entrepreneurs. Its client base and gross merchandise volume are both growing explosively.

As of June 2019, there are 820,000 Merchants from Shopify growing 55% from the prior year.

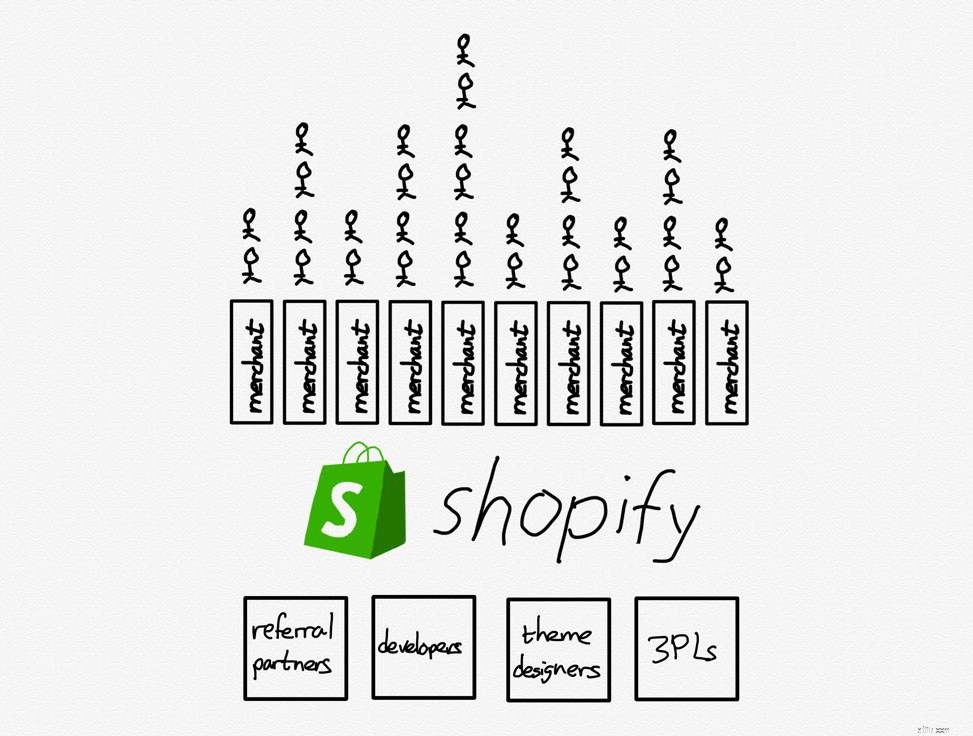

What does Shopify do?

Shopify is an e-commerce platform that allows merchants of all sizes to “set up” their own stores online. They all provide a suite of advantages such as fulfilment, payment and shipping services.

Shopify’s winning formula includes its platform’s ability to give online merchants an easy way to handle many aspects of their business:inventory management, fulfilling orders, processing payments, and communicating with current and prospective customers alike.

It is also extremely flexible with its ability to be connected with sites such as Ebay and social media such as Instagram. Small and medium-sized businesses still make up the core of Shopify’s clientele.

However, the company also offers a $2,000 a month Shopify Plus package for bigger businesses which the likes of Nestle and Red Bull utilize.

Shopify’s Growth Potential

The company estimates that there are 46 million small and mid-sized businesses around the world, and it’s only serving 1.3% of them. That leaves plenty of opportunities for Shopify to keep growing well into the future.

With the advent of the switch from traditional/physical shopping to online commerce, Shopify’s addressable market continues to grow as e-commerce captures a larger share of overall shopping.

Furthermore, one should note that Shopify isn’t a competitor to Amazon.

Amazon is an aggregator who internalises suppliers (people think they buy from amazon but actually make purchases from other suppliers).

Shopify as a platform externalises suppliers (people buy from various brands without knowing shopify powers them). There is nothing to purchase on Shopify.com other than its suite of platforms, unlike Amazon.

TLDR, Amazon is pursuing customers and bringing suppliers and merchants onto its platform on its own terms. Shopify is giving merchants an opportunity to differentiate themselves while bearing no risk if they fail.

The only way to beat an aggregator is to be a platform that externalise suppliers with differentiation.

For investors, this is a great business model which is still helmed by its charismatic and visionary founder, Tobi Lutke. In the long run, Shopify could potentially continue dominating the market and growing at a blistering pace.

With a huge untapped addressable consumer market and large growth capacities, Shopify as a fast grower could turn into one of the legendary Lynch Multi-Baggers.

| Market Cap. | $4.95B |

| Debt-to-Equity Ratio | 7.56 |

| Stable Top &Bottom Line Y-O-Y | Yes |

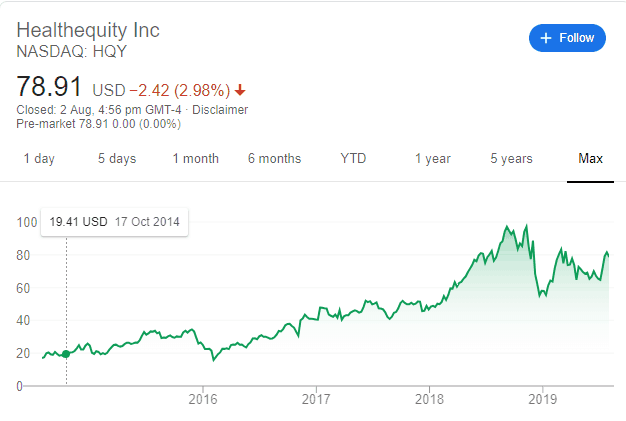

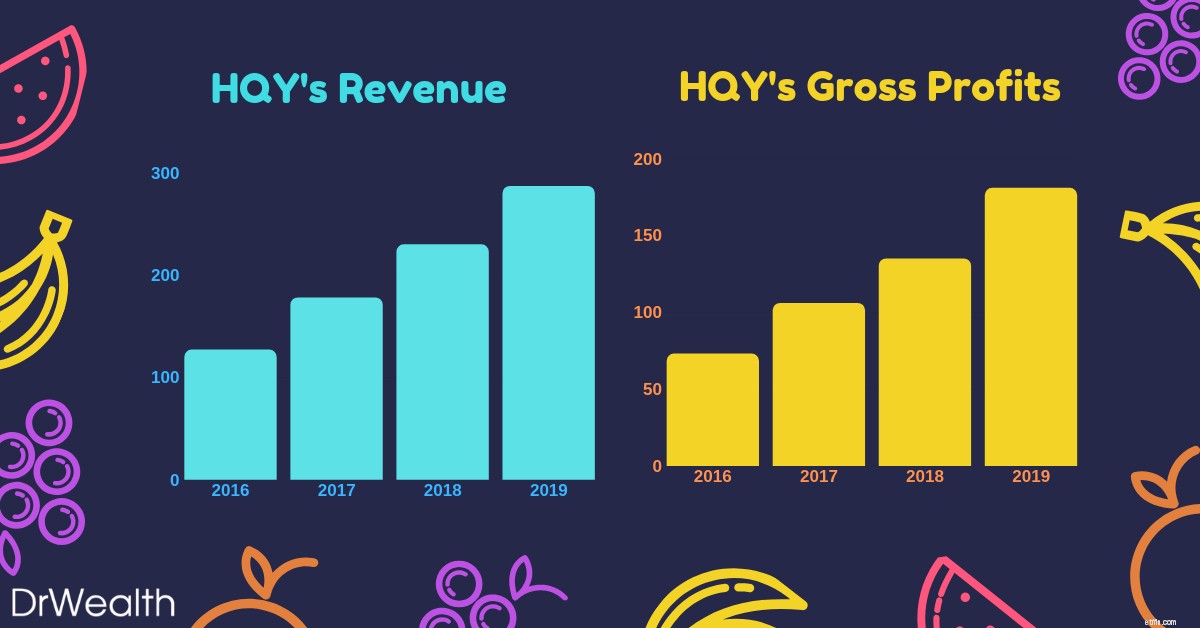

As seen in the graph, Health Equity’s earnings have been growing year-on-year from 2016 to 2019. Earnings grew from $135M in 2018 to $181M in 2019, displaying a 34% growth versus the prior year.

HealthEquity is not only profitable but has also seen impressive profit growth to go with rising sales in recent years.It’s identified multiple pathways toward future expansion that includes both organic growth and potential strategic transactions.

What does Health Equity do?

Health Equity is a cloud-based platform that provides access to Health Savings Accounts (HSAs) and other health-care benefits.

HSAs were implemented by the US Federal Government in 2003. It allows one to set aside cash for certain healthcare expenses that are not covered by their insurance.

HSAs come with huge tax benefits:money placed inside of HSAs are tax-deductible, and investments inside the HSA grow on a tax-deferred basis.

Additionally, withdrawals from HSAs aren’t taxed as long as the money is used to cover qualified healthcare expenses.

They help employers and employees alike to save on healthcare costs while taking advantage of tax incentives provided.

Health Equity’s growth potential

Health Equity’s business model is also simple:

With recurring revenue and simple services, Health Equity is definitely in it for the long run.

Furthermore, its founder, Stephen Neeleman was one of the doctors that lobbied for the federal government to implement HSAs and then subsequently built the platform, Health Equity to trade the accounts.

Rising Health Care costs will definitely be a huge proponent that drives up the demand for Health Equity services and products.

As the number of discerning healthcare consumers expands exponentially, interest in Health Savings accounts and highly deductible savings plans will rise in tandem.

For investors, the rising number of consumers being aware of Health Savings Accounts will drive demand for Health Equity’s platform. This would subsequently propel top-line sales and in turn, earnings.

With Earnings growth comes appreciation in stock prices.

So there you have it. The Fast Growers Category explained in accordance with Peter Lynch’s guidebook. If you choose wisely, this is the land of the 10-40 baggers and even the 200 baggers. However, Lynch reminds us that there’s plenty of risk in fast growers, especially in the younger companies that tend to be overzealous and underfinanced.

The stock market also does not look too kindly fast growers that run out of steam and turn in to slow growers. Hence, it is essential to figure out when the company is going to stop growing (lack of future plans, depreciating financials and loss of key leadership).

As one would notice, Peter Lynch identifies a stock using Qualitative Analysis before diving into the Quantitative.

That means he looks at a stock’s story before he looks at a stock’s business. There is nothing inherently wrong with that.

Whether you approach it from the numbers angle or the story, both ways work. However, we would advise retail investors to focus on approaching stock investing from the quantitative side of things.

This is to avoid biases and to avoid falling in love with a stock’s story. To hunt growth stocks, we have developed a robust, evidence-based framework that has delivered stellar returns per year historically. You can join us at a live session to learn more.

Next, we would be going in-depth into one of the six different categories pointed out by Lynch – The Asset Plays

Asset Plays are stocks that are believed by investors to be undervalued because the current price does not reflect the current value of the company’s assets displayed on its balance sheet.

The rationale for purchasing the stock is that the company’s assets are being offered to the market relatively cheaply, making it attractive to investors.

It would be sort of like buying a house for $0.40 on the $1.

Investors who utilize this strategy believe that the market overreacts, resulting in stock price movements that do not correspond with a company’s long-term fundamentals, giving an opportunity to profit when the price is deflated.

In fact, here at Dr Wealth, we employ our Conservative Net Asset Valuation (CNAV) method to identify to evaluate and select deeply undervalued Asset Plays.

We provide “Skin in the Game” case studies of our winning stocks that were hand-picked using our proprietary CNAV screener, substantiating them with past transaction statements.

We would thus be picking stocks utilizing the following criteria to select our Top 3 Asset Plays:

To elaborate a little further on the above criteria:

Dette er den formel, vi bruger til at beregne en akties konservative nettoaktivværdi:

All of which can be found in the Balance Sheet of the company’s financial statements.

We would then take the CNAV2 value, divided by total shares outstanding to find the CNAV2 per-share value .

Thus, if the CNAV2 per-share value is HIGHER than that of the current price per share, it is deemed to be on a discount.

To make our selection more stringent, we turn to Dr Joseph Piotroski’s F-score to find fundamentally strong low price-to-book stocks that are worth investing in.

As we have already added conservativeness, we do not need to adopt the full 9-point F-score. A proxy 3-point system known as POF score would be used instead.

It stands for Profitability , Operating Efficiency and Financial Position .

The stocks selected has to have a POF score of 2 and above.

To learn more about the POF score and how we use it in our investment strategies, click here.

An easy way to bypass such subjective questions is to look at whether management owns the majority of the shares in the company.

Today, we would be looking at the Hong Kong Stock Exchange market due to the recent correction caused by the protests. This resulted in many counters being ‘On-Sale’ even though its fundamentals have not faced any drastic changes.

To facilitate your reading, we have structured the content into clear and concise points to sum up what you have to know:

While there isn’t a hard and fast exit strategy, at Dr Wealth we would either sell at the 3 year holding period , when the Financial Fundamentals change or when a key qualitative point has been changed (i.e. change of CEO/founder steps down).

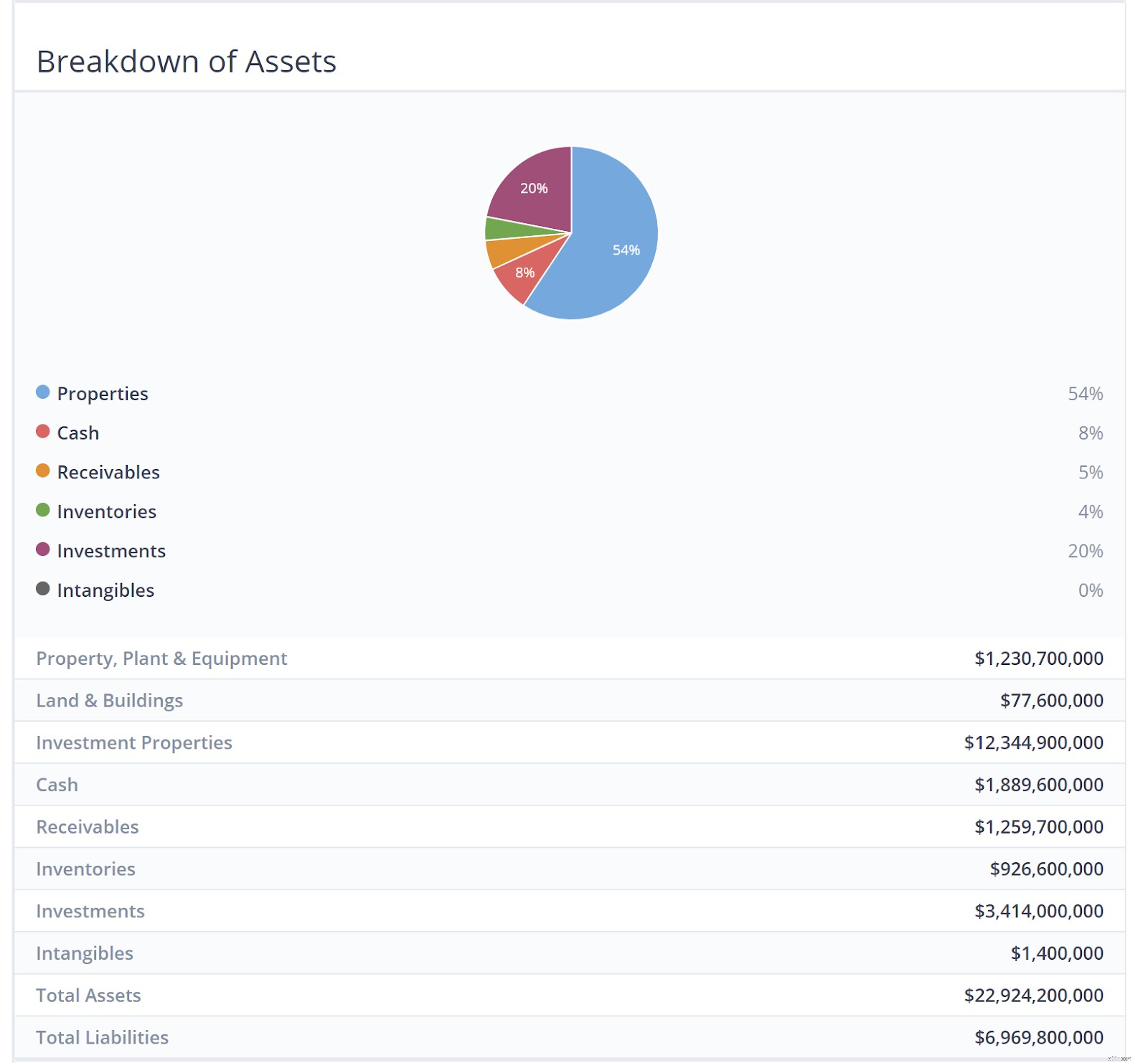

| Market Cap. | $1.173B |

| Market Price | $0.173HKD |

| CNAV2 Value per share | $0.386HKD |

| Net Asset Value per share | $0.659HKD |

| POF score | 3 |

| Potential Profit | 281% |

Emperor Watch &Jewellery is a retailer of European-made internationally renowned watches such as Patek Philippe, Rolex and Tudor. This is coupled with the sales of self-designed fine jewellery under its own brand, ‘Emperor Jewellery’.

The company has a history of over 75 years, establishing over 90 stores across Hong Kong, Macau, mainland China, Singapore and Malaysia, as well as an online shopping platform, and now has over 1,100 staff.

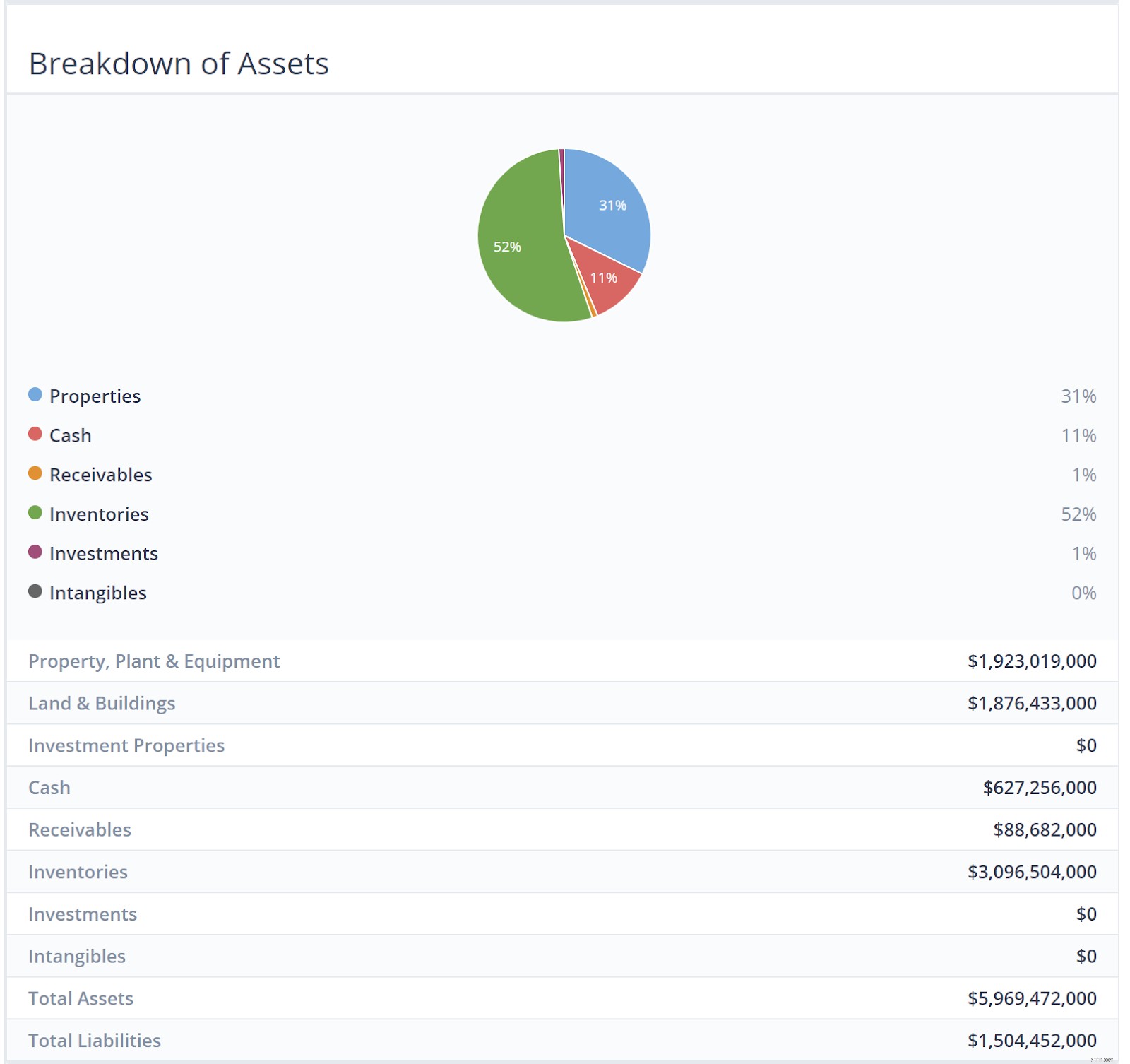

As seen in the infographic above, Inventories and Properties make up the bulk of their assets. There is a whopping HK$3.09 billion worth of luxury watches and Jewellery.

My hypothesis was that it wouldn’t be that bad because luxury watches and jewellery retain value pretty well as long as they are not worn and still in good condition.

We went ahead to discount the current inventory of watches and jewellery at 50%. We should account for a large margin of safety when calculating the valuation of Emperor Watch &Jewellery.

The Company’s core strategy focuses on maintaining its position as the leading watch and jewellery retailing group in Greater China, coupled with an eye on expansion beyond the region.

As most of their customers are mainlanders, boutique stores that peddled luxury goods such as watches and jewellery enjoyed the patronage of this swell of new customers as a result.

However, most of this all came to a halt when President Xi Jing Ping decided to rein in on the corruption.

This discouraged ostentatious displays of wealth in public. Sales of luxury goods to Chinese consumers slowed for a time and as earnings dropped, so did share prices.

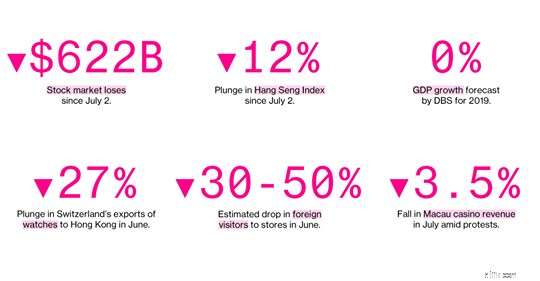

Coupled with the recent 10 straight weeks of anti-government protests in Hong Kong, stock prices in the HK Exchange have inevitably taken a massive beating. This is without even mentioning the massive backdrop created by the Trump-China trade war affecting prices as well!

More than $600 billion of stock market value has been erased since early July thanks to the riots and protests.

The culmination of all these events have thus done something favourable for us; create opportunities for us to businesses at fantastic bargain prices.

| Market Cap. | $97.101B |

| Market Price | $47.4HKD |

| CNAV2 Value per share | $68.357HKD |

| Net Asset Value per share | $105.846HKD |

| POF score | 3 |

| Potential Profit | 121% |

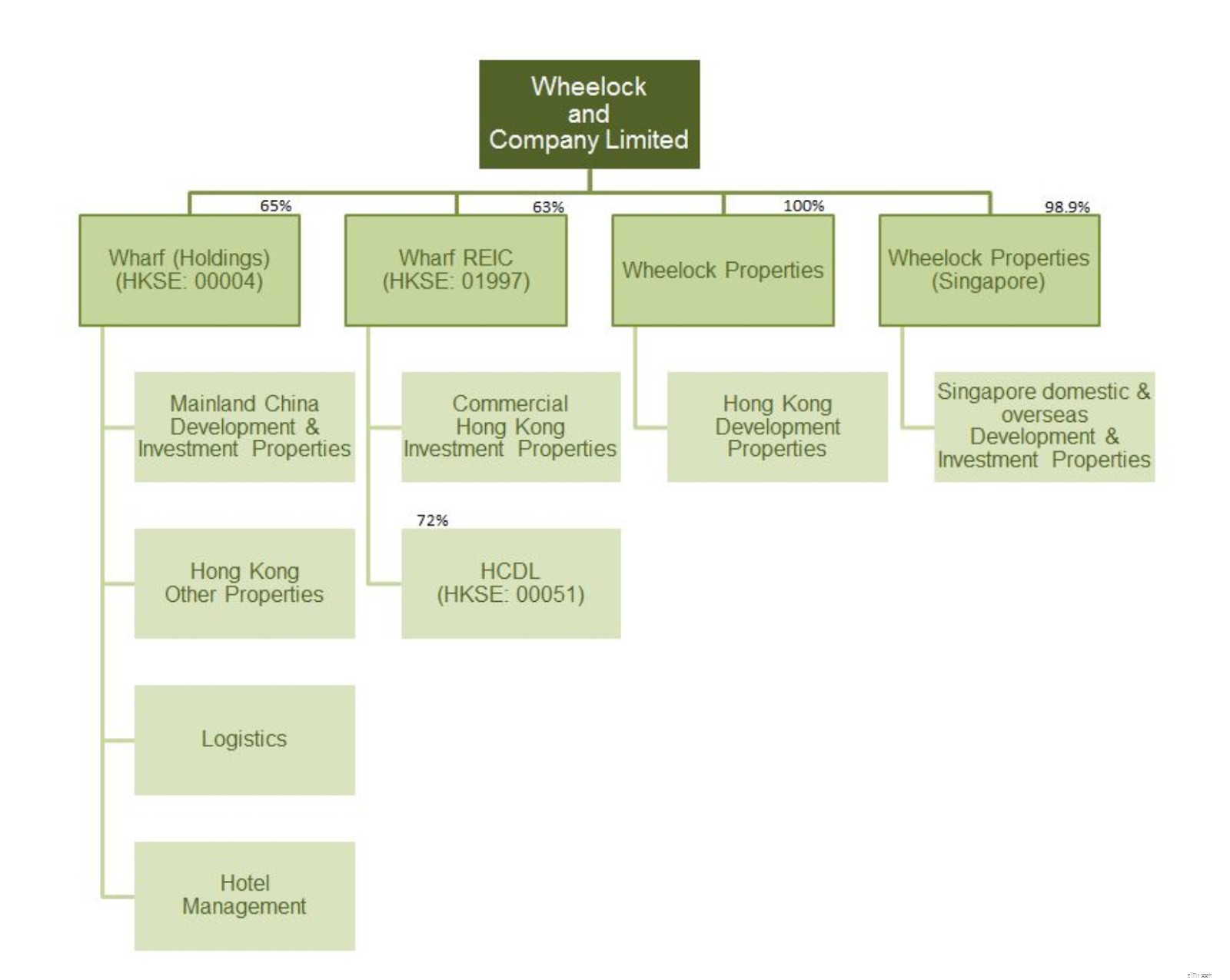

Wheelock &Co. is principally engaged in property development in Hong Kong, and in property investment and development in Singapore.

Their major subsidiaries include Wharf (Holdings) Limited (HKSE:00004), Wharf REIC Limited (HKSE:01997), Wheelock Properties Limited and Wheelock Properties (Singapore) Limited.

As seen in the infographic above, Properties make up the bulk of their assets. This should be rightfully so as they are engaged in the property development business.

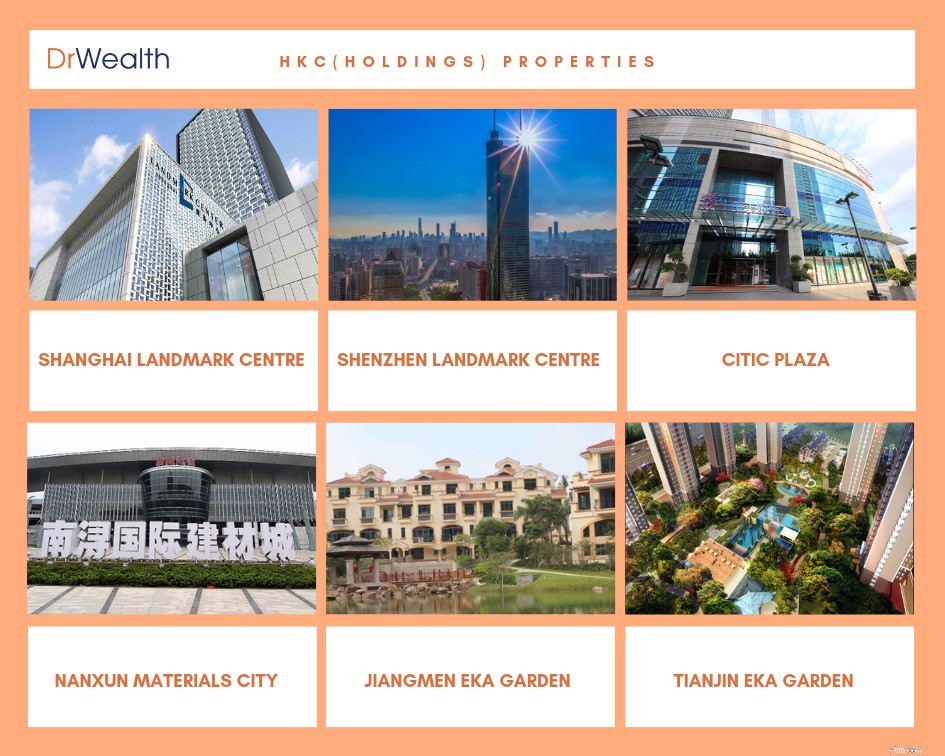

Due to the sheer amount of properties available in the company, we would only touch on the assets of Wheelock Properties here.

Kindly refer to the company’s website should you like to find out more about its other major subsidiaries asset breakdown.

| Market Cap. | $2.48B |

| Market Price | $4.69HKD |

| CNAV2 Value per share | $15.067HKD |

| Net Asset Value per share | $24.966HKD |

| POF score | 3 |

| Potential Profit | 420% |

The Group is a Hong Kong-based property developer focusing on investing and developing property projects in Mainland China and aims to develop high-quality products to create sustainable value for its shareholders.

The Group has a diversified property portfolio model with investments in both residential projects for sale and commercial projects mainly for rental income.

The group is organized into 3 main operating segments:

Over the long term, the Group seeks to maintain a balance between residential development for sale and commercial investment properties for lease in order to create a sustainable model with growth potential.

Residential properties for sale generate fast turnover, which should enhance return on equity. Investment properties for lease, on the other hand, create steady recurring income and cash flow as well as long term capital appreciation and are relatively immune from the periodic restrictions on residential properties.

The Group has also made an investment in the renewable energy sector and believes shareholders may benefit from China’s need to develop non-polluting sources of energy.

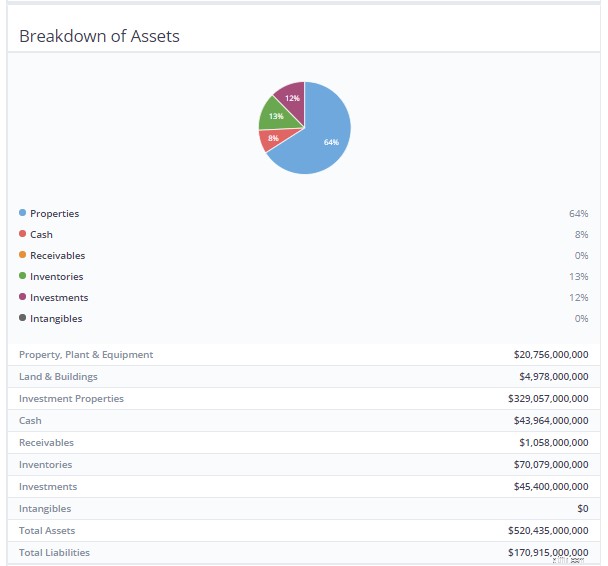

As seen in the infographic above, similar to Wheelock &Co, Properties make up the bulk of their assets. This should be rightfully so once again as they are engaged in the property development business.

The assets are mostly located around the more developed, coastal regions of China – where population density and income levels are much higher.

This could largely be attributed to the slowdown of the Chinese property sector in 2018. China’s massive property market is expected to cool further in 2019, with smaller price rises and falling home sales adding to pressure on the world’s second-largest economy, a Reuters poll showed.

As a result, residential sales volume began declining in the second half of 2018, with declines of 1% year on year in September and October and 4% in November. It increased by 2.5% in December, but poor Chinese New Year’s data suggest that the decline will continue into 2019.

Moreover, the price rise growth for new residential properties has decelerated for the third straight month. In January, residential prices for 70 major cities increased by only 0.61% compared to December, the slowest pace in nine months.