Så du er ret sikker på, at du vil gå på pension i USA, men hvor præcist inden for de 50 stater vil du slå dig ned efter dine arbejdsår?

Hvert år hævder flere undersøgelser, at de kan vise dig, hvilke stater der er bedst eller værst til pensionering. Men de er næsten aldrig enige, så du er tilbage til at sammenligne deres anbefalinger og drage dine egne konklusioner. Og hvem har tid til det, mens du forsøger at få din pensionsopsparing opdelt?

Nå, vi har din ryg. For at skære gennem rodet af pensionsstudier har vi taget tre af disse årlige statsrangeringer og har i det væsentlige sat et gennemsnit af dem til en masterliste. Du kan måske betragte disse som de værste af de værste stater for pensionering - tæller ned til staten helt nederst.

VORES METODOLOGI:Vi tilføjede hver stats pensionsrangering fra Bankrate, WalletHub og MoneyRates for at skabe resultater ud af 150 mulige . Jo højere score, jo lavere rangerer staten som pensionistdestination.

Score:74

Colorado byder på spektakulære landskaber, frisk bjergluft, bryggerier, skiløb, storbyfaciliteter og småbycharme.

Sundhedsvæsenets kvalitet er høj, og det samme er den generelle livskvalitet. Så hvad skal man ikke elske ved Centennial State? (Som opnåede stat i 1876, da nationen var 100 år gammel - deraf kaldenavnet.)

Bankrate siger, at Colorados leveomkostninger er i overkanten. Den gennemsnitlige boligpris i Denver i slutningen af 2019 var relativt stejle $458.000, ifølge National Association of Realtors. Derudover siger AARP, at staten er en af 13, der kan beskatte dine sociale ydelser.

Colorado ender også blandt de værste stater på grund af dets ofte uforsonlige vejr. "Det er ikke ualmindeligt at have 70 mph vind med enhver storm," skriver Colorado bosiddende John Jamieson, på Quora.

Score:75

Pennsylvania har et livligt klima i fire sæsoner med blomstrende forår, varme og fugtige somre, behagelige og farverige efterår og ærlige vintre.

Keystone State byder på en større ligaby på begge sider og en masse smukt land imellem. Pittsburgh har bakker i San Francisco-stil, masser af historie og gode underholdningsmuligheder. Philadelphia byder også på masser af historie, plus førsteklasses sundhedspleje, god offentlig transport, en stor international lufthavn og gåvenlige kvarterer.

Men Pennsylvania er ikke så overkommelig som mange andre stater, ifølge både Bankrate og WalletHub. Du vil gerne arbejde med en finansiel planlægger for at hjælpe dig med at strække dine pensionskroner her.

"Pittsburgh-skatter er dyre, skriver en Reddit-bruger. "Og skatter i Pennsylvania som helhed er ret dårlige. Det ser ud til, at jo længere du flytter ud fra byen, falder skatterne, men prisen på fast ejendom stiger."

Score:77

Maines charmerende samfund og smukke landskab kan gøre det til et ideelt pensionistmål. Pine Tree State byder på rolige græsgange, frodige skove, en smuk kystlinje og nogle af de sikreste byer i landet.

Men stigende priser lægger pres på pensionisternes bankkonti, og man skal være villig til at affinde sig med det ofte barske klima.

Bankrate rangerer Maine som nummer 48 ud af 50 for sit vejr, som inkluderer fugtige somre, der bringer mere end 40 arter af myg frem, og lange, kolde, snedækkede vintre.

"Jeg vil foreslå, at du anskaffer dig hjælp til snerydning og planlægger at få snedæk, planlægger at få dit hjem vurderet til vores vejr, planlægger at betale mere, end du har for din varmeregning," skriver Mainer Crystal Laplante på Quora.

Score:77

South Carolina kan prale af smukke strande, gode golfmuligheder, dejlige køreture i landskabet og masser af sydstatshistorie.

Men Palmetto-staten har nogle få ulemper for pensionister, nemlig med hensyn til sundhedspleje og levestandard.

Bankrate siger, at South Carolina rangerer sidst for sine seniorers velvære, og WalletHub scorer det lavt for livskvalitet.

Staten får en god karakter for sit vejr, selvom det ikke er alles kop sød te. "Varmen er helt monstrøs om sommeren," skriver Reddit-brugeren superflippy. "Bare sørg for, at der er god aircondition, uanset hvor du bor."

Score:77

Kentucky er hjemsted for fritflydende bourbon og den spektakulære Red River Gorge, og staten tiltrækker international opmærksomhed hvert år for det pragtfulde og pulserende spænding ved Kentucky Derby.

Omkostningerne og kriminalitetsraterne er lave, men WalletHub rangerer Kentucky som nr. 50, den allerværste stat for pensionering, fordi den siger, at sundhedspleje og den generelle livskvalitet i Bluegrass-staten er dårlig.

Og alt det smukke græs afgiver så meget pollen, at Kentucky er kendt som USA's allergihovedstad. Det er også en andenplads til førstepræmien i kategorien "knusende fugtighed."

Tempoet i livet her kan være langsomt - for langsomt for Kentuckian Tiffany Bridgeman på Quora:"Hvis jeg vil have nogen til at komme ud for at f.eks. arbejde med VVS, er jeg nødt til at ringe på en mandag for måske at få nogen til at komme ud på en fredag eller næste tirsdag. Det tager en måned at få en lægetid og en uge at bede om genopfyldning."

Score:78

Som alle, der har set filmen eller tv-serien Fargo North Dakota-vintre kan være brutale. Vil du bruge en stor del af dine pensionistår begravet under trøjer og tæpper?

Bankrate siger, at vejret her er næstværst for pensionister, efter Alaska.

"Min bedstefar plejede at joke med, at North Dakota havde to sæsoner, denne vinter og sidste vinter," siger Quora-kommentator Raymond M. Baesler, der siger, at han boede i Minot, North Dakota, i fem år.

Hvis du kan klare kulden, har North Dakota nogle fordele for seniorer. Selvom staten i det mindste i nogle tilfælde beskatter sociale ydelser, er leveomkostningerne her lave, og sundhedssystemet i staten scorer højt.

Score:78

Bjergrige West Virginia byder på masser af udendørsaktiviteter, naturlige mineralkilder og kurbade - og nogle af de laveste leveomkostninger i USA. I hovedstaden Charleston er den gennemsnitlige salgspris for et hjem kun 133.200 $, ifølge National Association of Realtors.

Du får sandsynligvis mange venner, hvis du beslutter dig for at gå på pension her, fordi staten ifølge MoneyRates har en af de højeste procentdel af indbyggere på 65 år eller ældre, kun efter Florida og Maine.

Og her er endnu et plus for seniorer i West Virginia:Staten har påbegyndt en treårig udfasning af sin skat på sociale sikringsydelser.

Men mens sundhedspleje er overkommelig her, har West Virginia nogle af de værste patientresultater på landsplan. WalletHub rangerer den sidst blandt staterne for sundhedsplejekvalitet, og Bankrate placerer dens 39. blandt de 50 stater for senior wellness.

Score:80

If you’re willing to cheer for Boston no matter the sport, and if you're seriously into American history, Massachusetts could be a perfect retirement location.

The state is well known for its excellent health care, but costs can be high and winters can be rough. Homes in metro Boston are selling for a median $482,800, and winter snowfall totals across Massachusetts typically hit 100 inches.

"As you get older, you will have to figure out how somebody besides you is going to shovel you out of your house in the winter so you don’t risk a heart attack doing it," writes former Massachusetts resident Anne Agard, on Quora.

But when temperatures drop below freezing, you can always warm up by having a bowl of Boston clam chowder, a local delicacy.

Score:88

Tennessee might the ideal spot for music fans to settle down. But the Volunteer State also hits a few sour notes as a potential retirement destination.

It boasts two cities that helped define the music industry:Nashville is the center of the universe for country music, and Memphis is home not only to bluesy Beale Street but also to Graceland, Elvis Presley’s iconic estate.

Additionally, the state gives us Tennessee barbecue, a dry-rub style that will tickle any foodie’s taste buds. Plus, it scores well for affordability. In Knoxville, the median selling price for a home is just $209,400.

But WalletHub ranks the state 48th for quality of life, and FBI data shows Tennessee is among the worst states for violent crime.

Score:92

Though Georgia covers over 59,000 square miles, most of its population is concentrated in the northern part of the state, around Atlanta.

Residents in that densely populated and often congested area have city living, major league sports, a major international airport, sedate rural areas and the ocean all within reach.

But it can be harder to find things to do across much of the rest of Georgia. Bankrate ranks the Peach State all the way down at No. 45 when it comes to culture.

The state's weather extremes can be a challenge, too. "Our weather in North Georgia is just about freezing or below at times and at 98 or above at times," writes Georgian Ellen Lawson, on Quora. Blizzards, tornadoes and hurricanes are all common in the Peach State.

Score:92

If you retire to Mississippi, you'll be greeted by generally warm, pleasant weather, delicious Southern cooking, the lovely flowering trees that give the Magnolia State its name, and a very low cost of living.

But while you won't have to spend much here, Mississippians don't earn much either. It's a poor state with the lowest median household income, according to recent census data:$42,781.

The retirement research studies rank Mississippi near the bottom for both quality of life and health care, and the state doesn't score well for cultural amenities either.

"It's extremely slow and feels like it's behind the times," says former resident Marla Jackson, on Quora. "There isn't a lot to do (at least where I lived in Southwest Mississipi)."

Score:97

Those who retire to Minnesota can expect to find excellent medical care (the Mayo Clinic is based here) fun festivals and fairs throughout the year — and chilly winters that seem to last forever.

"Minnesota does have long winters," writes Minnesotan Alicia Bayer, on Quora. They are brutally cold (far below zero many days of the year) but they also stretch on. The first snow often hits in October and it's not unheard of to have the last snow in May. It gets old."

While Minnesota gets low marks for its punishing weather, WalletHub names it the No. 1 state for both quality of life and health care.

But the cost of living is relatively high here, and Minnesota collects taxes on retirement income. Social Security is taxed for some beneficiaries, but the state legislature is considering whether to end that practice.

Score:102

Chicago is Illinois’ cultural hotspot, but the state also features peaceful suburbs, a wine trail, and beautiful lakes and cottages just right for retirees seeking to unwind.

So why is the Prairie State among the worst for retirees? The state is not considered very affordable. Illinois property taxes are notoriously high, and state and local sales taxes add as much as 11% to the cost of a purchase.

Plus, it's not the most healthy state:Bankrate says Illinois ranks 49th for wellness. (Maybe that has something to do with the popularity of deep-dish pizza here?)

And we haven't even mentioned the weather. Summers bring high temperatures and humidity, and the winters are known for their bone-chilling cold and biting snowstorms. "The best place to be in Illinois is leaving," says former resident Mark Madison, on Quora.

Score:103

Connecticut is known for its small-town New England charm and its spectacular shows of color during the season for autumn leaves.

Retirees will appreciate the Nutmeg State's high-quality health care, which is reflected in the high level of wellness among Connecticut seniors.

But prices and taxes can be stiff here, so to get by in Connecticut you'll need the help of a financial planner. Those services are more affordable than you might think and are even available online now.

Connecticut resident David Dill writes, on Quora, "Taxes are very high. Between car taxes, gas taxes, income taxes, property taxes, estate taxes, corporate taxes it just never ends." Older residents are getting some relief, as the state is phasing out its tax on Social Security and other retirement income.

Score:108

Nature lovers are drawn to Oregon for its snowcapped mountains, misty forests, crystal-clear lakes, alluring Pacific coastline and magnificent rivers and waterfalls. Other attractions include the state's hundreds of wineries and breweries — and the famously weird hipster culture in Portland.

But Oregon's popularity is helping to drive up costs, making the Beaver State an expensive retirement destination. The three retirement research studies we looked at give Oregon low marks for affordability.

The median selling price for a house in the Portland metro area is a not-cheap $410,900. Think you'd rather rent? A report from the National Low Income Housing Coalition found renters earning an average full-time wage can’t afford a one-bedroom apartment in Oregon.

"If you want to retire in Portland, I hope you are making good money in your retirement," says former longtime Portland resident Geoff Arnold, writing on Quora. "No, seriously, if you aren’t clearing around 4–5 grand a month — forget it."

Score:112

In Louisiana, the people are lovely, the food scene is fantastic, the music is amazing, and the natural surroundings are awe-inspiring. Sounds like a fabulous place to retire, right? You may want to think twice.

Sales taxes can be as high as 11.45%, the state's murder rate is the highest in the nation, and Louisiana scores poorly for health care quality.

"I've lived here all my life and i HATE IT," says Quora user Delani Lass. "It is horribly hot in the summer. (100 degrees with 100% humidity) Summer lasts from April until September/October. It gets cold once a week for two whole days, then it warms back up."

And don't forget about the hurricanes.

Score:116

California offers retirees beaches, mountains, wine areas, and bustling cities bursting with cultural amenties. And all of those things come with high price tags.

Bankrate says it's the one of the least affordable states, and the astronomical housing prices are a major reason. The California Association of Realtors says the median selling price for a single-family home statewide is close to $600,000.

California doesn't tax Social Security, but all other types of retirement income are fair game. Depending on where you're shopping, the sales tax can be as high as 10.25%.

More than half (53%) of Californians think about fleeing the state to get away from the high costs, a 2019 survey by Edelman found.

Score:118

New Mexico is known for its colorful Southwestern culture, its zany local festivals and its amazing Mexican-inspired food. The state's rugged beauty will beg you to stay and settle down — but it might be better to just visit.

Social Security, retirement account distributions and pension payouts are all taxed here, and WalletHub says the state nicknamed the Land of Enchantment gives retirees a substandard quality of life.

"New Mexico is a relatively poor state so prices for land and houses are low, as is the general cost of living, but this also means a relative paucity of amenities," says Quora commenter William Hembree. "Albuquerque is the only really large city if you’re looking for a more urban lifestyle."

And maybe the producers were right to choose New Mexico as the setting for Breaking Bad and Better Call Saul , because Bankrate says the state is one of the worst for all types of crime.

Score:119

The relatively tiny Ocean State offers more than 100 public beaches, delicious seafood and loads of history to keep you engaged in your retirement. Rhode Island also scores high for safety and culture.

But the state is no bargain. A one-bedroom apartment in downtown Providence rents for more than $1,500 a month, according to the cost-of-living website Numbeo, and a three-bedroom goes for more than $1,900, on average.

Health care is so-so, and the medical costs can be downright painful. So can a drive on one of Rhode Island's major roads, because 79% are in poor or mediocre condition, according to the transportation research group known as Trip.

Quora user Cole Rinne says the weather isn't great either:"Like most of New England, Rhode Island has some gnarly weather. It is cold in the winter and gets very humid in the summer. Being such a small state it is impossible to get very far from the coast and flooding and hurricanes/noreasters is a problem."

Score:120

New Jersey might sound like a place with everything you’d want for your retirement:beaches; greenery (it is the Garden State, after all); great shopping and restaurants; casinos and golf courses; and your pick of small towns, suburbs or cities to settle in.

The main problem for retirees is that New Jersey is so expensive; both Bankrate and WalletHub put it near the bottom for living costs. In the Newark metro area, the median selling price for a home is close to $400,000.

"Property taxes in New Jersey are particularly high, as is the cost of real estate. There’s a reason why many New Jersey residents move to other states after they retire," writes former New Jerseyan Tom Coughlin, on Quora.

When you live in Jersey, you also have to contend with terrible traffic, serious urban crowding, and winters that can be unbearably cold, especially in the northern reaches of the state.

Score:121

The Evergreen State truly lives up to its name, with parks, mountain ranges and hiking trails throughout. Oh, and did we mention it has one of the best coffee scenes in the world? Maybe it's no wonder Washington scores high for quality of life.

Washington’s fantastic lifestyle comes at a cost, however:It's one of the most expensive states to live in. In metro Seattle, homes are selling for a median price of $528,800.

Though Washington is one of nine states with no income tax of their own, people who live here say the trade-off is you can expect to pay stiff sales and property taxes.

Rainy, overcast weather is another common source of complaints. "From November to February the sun actually never comes up. Not literally, but sunrise is around 8 a.m. and sunset is before 5 p.m., and it's constantly cloudy, so it just feels like perpetual night for three or four months," writes Quora's Dyonysos Larson.

Score:129

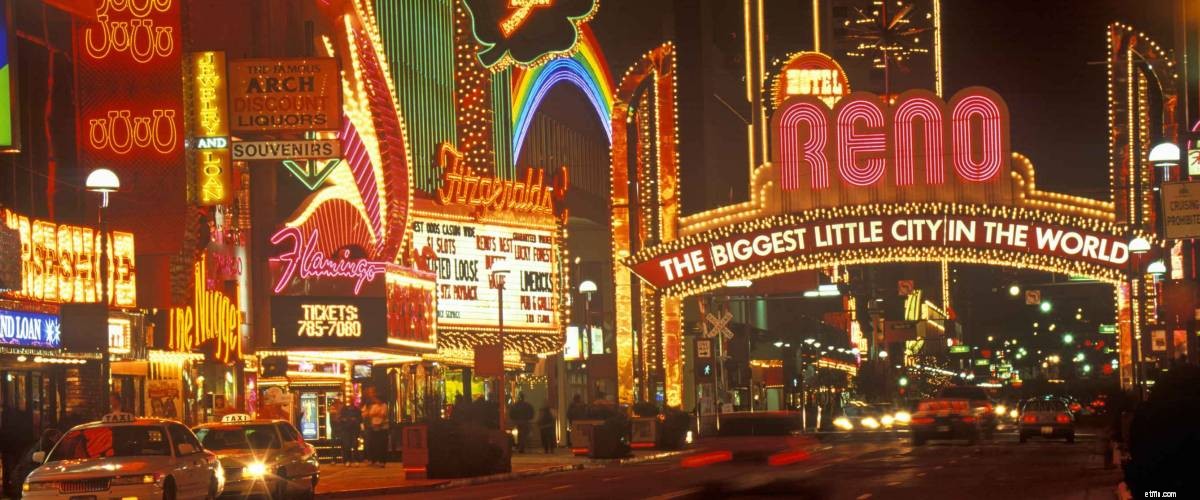

Roll the dice on a retirement in Nevada if you love gambling and nightlife. Las Vegas and Reno are known for their casinos offering slots, table games, buffets that go on for miles, and world-class shows. If all of that appeals to you, you won't be bored living here.

The Silver State also offers a warm climate and gorgeous natural attractions, including the breathtaking Valley of Fire. Nevada is considered tax-friendly for retirees, particularly since it's another of the states without a state income tax.

But it rates low for health care, the wellness of its seniors, and their overall quality of life.

"Don’t go TOO far from the population centers if you need complex medical treatments," warns Nevadan Burt Andrews, on Quora. "Most small towns here have basic medical services, but the complex stuff is concentrated in the two population centers [Las Vegas and Reno]."

Score:129

Not only does Alaska not have a state income tax, but there's not sales tax either. And, in fact, they pay you to live here. Every resident receives some money annually from Alaska's oil wealth fund, which paid out $1,606 to each adult and child in Alaska in 2019.

With its mountains, fjords and beautiful glacier views, Alaska packs plenty of retirement appeal — but the long, dark winter days and ravenous summer mosquitoes will take some getting used to.

Bankrate ranks Alaska in last place for weather, and second from the bottom for crime. The most recent data from the Alaska Department of Public Safety shows the state's violent crime rate in 2018 was the worst in five years.

Also, you'll pay more for most items in Alaska, because merchandise must be transported up north. If you move here, you'll need long johns — and a lot of retirement money in the bank.

Score:135

Maryland was our very worst state for retirement in 2019, and the governor didn't disagree when he was asked about our last-place ranking.

This time out, the state is only a notch better, despite the many amenities that Maryland has to offer:history and culture; great golfing, mountains and beaches; a major population center within the state (Baltimore) and another one close by (Washington, D.C.).

The high cost of living here and high taxes are what make this state a less-than-ideal retirement destination. While it doesn't tax Social Security, Maryland does tax IRA distributions and some income from 401(k) plans and pensions.

"Unless you spent your life living somewhere with an equal or higher cost of living, you might not have the retirement funds to support living here," warns Quora user Casian Holly. "Even if you do, you're much less likely to recover from a financial crisis here than somewhere with a lower cost of living."

Score:138

In retirement, if you can make it here — well, you'll deserve a huge congratulations, because it's not easy.

The Empire State is the worst state for retirement, according to our composite scores based on the rankings from Bankrate, WalletHub and MoneyRates.

The big issue is that it's so expensive to live in New York, which the studies identify as America's least affordable state. In glitzy New York City, one-bedroom apartments rent for an average of about $3,300 a month . You'll need a lot of savings and a financial planner you can turn to.

New York state residents pay the highest state and local taxes, the Tax Foundation says. Though up to $20,000 in retirement income can be excluded from the state's income tax, the tax breaks for retirees probably aren't enough to lighten the financial burden of living here.

Here's how our analysis ranks all 50 states as retirement destinations, going in order from the best to the worst. In several cases, states tied for spots in our ranking because they had the same average rank in the three studies we looked at: