Revolut blev lanceret i 2015 af forretningspartnerne Nikolay Storonsky og Vlad Yatensko som et forudbetalt kort. Det har siden udviklet sig til at tilbyde adskillige produkter, herunder en virksomhedskonto.

Revolut har lanceret en virksomhedskonto i et forsøg på at ruske op i forretningsbankerne og tackle de høje gebyrer, der er forbundet med traditionelle banker, når de sender penge til udlandet. Revolut beskriver sig selv som et 'digitalt alternativ til de store banker' og konti kan oprettes online og uden behov for at lave en aftale eller besøge en filial.

For at åbne en Revolut Business-konto skal din virksomhed være registreret med en fysisk tilstedeværelse i følgende lande inden for Det Europæiske Økonomiske Samarbejdsområde (EØS) og Schweiz:

Hvis din virksomhed opererer uden for disse områder, kan du registrere din interesse hos Revolut for at få besked, når de planlægger at udvide til det pågældende land.

Revolut Business støtter virksomheder, der er:

Det kan endnu ikke støtte velgørende organisationer, offentlige virksomheder, fonde og kooperativer, men Revolut siger, at det ser ud til at gøre det i fremtiden. For mere information om typer af virksomheder, der ikke accepteres hos Revolut, kan du gå til Revoluts hjemmeside.

Med Revolut Business-kontoen får du fordel af følgende funktioner:

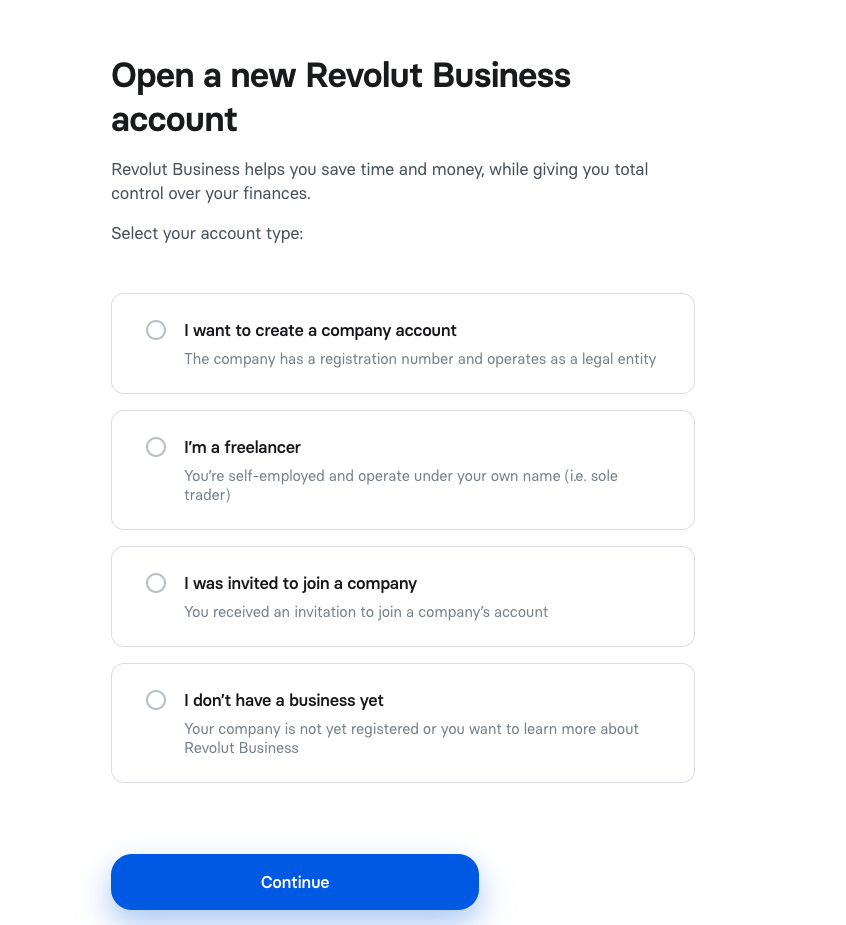

For at tilmelde dig Revolut Business skal du udfylde en onlineansøgning, der bør tage omkring 10 minutter. Ansøgningen bliver derefter gennemgået af Revolut, som muligvis skal kontakte dig yderligere. Ansøgningsprocessen tager normalt omkring 1-7 hverdage at gennemføre, men kan tage lidt længere tid.

Med Revolut business kan du åbne to typer konti; virksomhed og freelancer.

Når du har oprettet din virksomhedskonto, modtager du en konto i GBP med et kontonummer og en sorteringskode og en EUR-konto med IBAN- og BIC-oplysninger. Du vil nu være i stand til at opbevare, veksle og overføre dine penge mellem 28 valutaer inklusive AUD, EUR, GBP, JPY, RUB, THB og USD.

Mere end 500.000 virksomheder har tilmeldt sig Revolut Business, og antallet vokser støt. Gebyrerne for Revolut Business opkræves månedligt, og prisen varierer afhængigt af den type virksomhedskonto, du har åbnet.

| Plan | Gratis | Vokse | Skala | Enterprise |

| Månedlige omkostninger | 0 £ | 25 £ | 100 £ | Kontakt Revolut |

| Gratis metalkort | 0 | 1 | 2 | Tilpasset |

| Gratis klassiske kort | Ubegrænset | Ubegrænset | Ubegrænset | Ubegrænset |

| Gratis betalinger til eksisterende Revolut-konti | Ubegrænset | Ubegrænset | Ubegrænset | Ubegrænset |

| Antal gratis teammedlemmer* | 2 | 10 | 30 | Ubegrænset |

| Antal gratis lokale betalinger (gebyr 0,20 GBP pålægges uden for gratis tillæg)> | 5 | 100 | 1000 | Tilpasset |

| Antal gratis internationale betalinger (gebyr på 3 GBP pr. betaling uden for gratis tillæg) | 0 | 10 | 50 | Tilpasset |

| Realrente FX-godtgørelse* (0,4 % gebyr uden for gratis kvote) | 0 £ | 10k £ | 50k £ | Tilpasset |

| Gratis accept af forbrugerkortbetalinger i Storbritannien og EØS (1,3 % gebyr gælder uden for gratis godtgørelse, 2,8 % gebyr for alle andre betalinger) | 0 £ | 2k £ | 9k £ | Tilpasset |

| Behold og veksle 28 valutaer | | | | |

| GBP &EUR lokale konti | | | | |

| IBAN-nummer | | | | |

| Gebyrfrit forbrug i udlandet | | | | |

| Styring af tilbagevendende betalinger | | | | |

| Manage expenses | | | | |

| Payroll | | | | |

| 24/7 support | | | | |

| Team member permissions | | | | |

| Payment approval | | | | |

| Bulk payments | | | | |

| Perks | | | | |

* Additional charges applied after the free limit is exceeded, further details are explained below.

| Plan | Free | Professional | Ultimate |

| Monthly Cost | £0 | 7 £ | 25 £ |

| Free metal cards | 0 | 0 | 1 |

| Free payments to existing Revolut accounts | Unlimited | Unlimited | Unlimited |

| Number of free Local payments (£0.20 fee applies outside of free allowance) | 5 | 20 | 100 |

| Number of free International payments (£3 fee applies per payment outside of free allowance) | 0 | 5 | 10 |

| Real rate FX allowance* (0.4% fee outside of free allowance) | £0 | £5k | £10k |

| Free UK and EEA consumer card payment acceptance (1.3% fee applies outside of free allowance, 2.8% fee for all other payments) | £0 | £500 | £2k |

| Free initial company cards for each team member | | | |

| Hold and exchange 28 currencies | | | |

| GBP &EUR local accounts | | | |

| IBAN number | | | |

| Fee free spending abroad | | | |

| Payment approval | | | |

| Bulk payments | | | |

| 24/7 support | | | |

| Business API | | | |

| Perks | | | |

* Additional charges applied after the free limit is exceeded, further details are explained below.

With a Revolut Business account, the fees are billed monthly (every 30 days) and are deducted from your business account balance. If there are insufficient funds then the amount with be deducted from one of your other linked accounts.

Revolut says it is hoping to introduce loans and overdrafts, additional currencies, invoices and the ability to accept card payments in the coming months for both freelancer and company accounts.

Below is a summary of the limits applied to a Revolut Business Freelance and Company account. Any ATM withdrawal is subject to a 2% fee and any transfer over the free limit will be treated as a SWIFT payment and will be charged a £3 international fee.

| Freelance account | Company account | |

| ATM withdrawal limit* | £3,000 per day / £100,000 per month | £3,000 per day / £100,000 per month |

| Transfer in limit | No limit (transfers in over £250,000 a day may need extra information) | No limit (transfers in over £250,000 a day may need extra information) |

| Individual transfer limit | £250,000 | £250,000 |

| Total Daily Transfer out limit | £2.5million | £2.5million |

| Total weekly transfer out limit | £10million | £10million |

| Single payment limit | £250,000 | £250,000 |

| Daily payment limit | 50 | 2,000 |

| Weekly payment limit | 200 | 5,000 |

*Any ATM withdrawal is charged a 2% fee regardless of the amount

With no bank branches and everything based online it can make it hard to completely trust an 'app-only bank'. Revolut has applied for a banking license however it is not yet able to operate as a fully-fledged bank account. Revolut is an e-money institution and your money is therefore not protected by the FSCS, however, Revolut says it is committed to 'safeguard' money it receives from its customers in an account with a tier-one UK Bank. It is therefore protected by FCA requirements and in the event of the bank going bust, you would be entitled to claim your money back through those guidelines.

Any transactions made with a Revolut card are protected by Mastercard or Visa rules.

Revolut is rated as Excellent on Trustpilot with 4.4 out of 5 stars from over 89,000 reviews. 76% of users rate is as 'Excellent' and 9% of users rate Revolut as 'Bad'. There is no separate account for Revolut Business on Trustpilot but some customers have commented on problems with setting up Revolut Business accounts and how difficult it is to communicate via chat to resolve problems.

Revolut's closest competitors when it comes to business banking are Monzo and Starling. So how does it compare to its competitors? In the below table we summarise the differences between the free Revolut, Starling and Monzo business bank accounts. For more information on the Monzo and Starling business accounts read our reviews:

| Revolut | Starling | Monzo | |

| Cost | FREE | FREE | FREE |

| Deposit cash | | | |

| Free local transfers | | | |

| Instant notifications | | | |

| Categorised spending | | | |

| Integrated accounting software | | | |

| FSCS protection | | | |

| Direct debit | | | |

| Overdraft | | | |

| Free Cash withdrawal | | | |

*depending on the payment plan there is a limit to the number of free transfers

** this is available via the expense management tool with the paid-for business plans

Overall, Revolut business has a range of business accounts to suit most business types and you can benefit from its free basic account or enhance the features on offer with its premium accounts. Revolut Business may be worth considering if your company deals in a range of currencies as its multi-currency account allows you to hold money in up to 28 currencies and easily make payments worldwide.

However, if you need to make regular cash or cheque deposits to your business account then you may wish to consider its competitors such as Starling or Monzo, as this is not something that Revolut offers. Another thing to consider is that Revolut is not yet a full UK bank account so you are not yet able to benefit from FSCS protection.

Sådan får du den billigste sundhedsforsikring

Amazon Drone-levering er lige kommet tættere på virkeligheden

Har du nogensinde fundet dig selv rådvild, når det kommer til at træffe beslutninger? Sådan holder du op med at være ubeslutsom - især når det kommer til penge.

Syv ting

Afgrøde- og høstforudsigelser fra USDA-rapporten om afgrødeproduktion:2020